(This is an excerpt from an article I originally published on Seeking Alpha on October 14, 2012. Click here to read the entire piece.)

U.S. homebuilders continue to beat a drum of optimism. KB Home (KBH) is no exception. In its July earnings report, KBH established a strategy of “Going on Offense”. KBH provided more details on its aggressiveness in its latest earnings report, calling this strategy a “rally cry for growth…to be bold and aggressive in pricing, gross margin enhancement, model opening timelines, land acquisition and compression of cycle times.”

I read through the transcript for the KBH earnings call looking specifically for more evidence of the strengthening demand for housing. It appears that KBH’s good fortunes rely heavily on continued strength in some of today’s hottest housing markets in the U.S.

{snip}

This bullishness caught the attention of Bloomberg. In a recent article titled “California Leading U.S. Out of Housing Bust: Mortgages,” Bloomberg includes some choice quotes from KBH’s conference call. The article provides an accumulation of data from different sources that support KBH’s bullish claims in the state: {snip}

While I am waiting for 2013 guidance to make a judgement on valuation for KBH, Seeking Alpha contributor John Giluly estimates a $20 fair value for KBH based on book value…{snip}

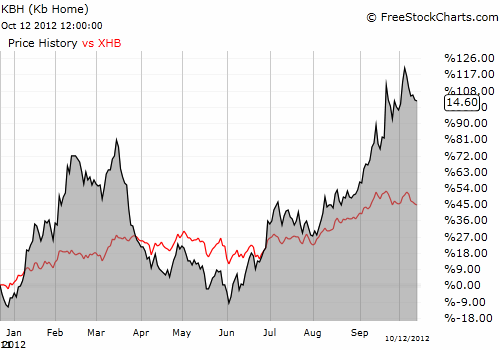

Finally, KBH’s brief under-performance relative to the SPDR Homebuilders Index ETF (XHB) ended at the market lows in early June. KBH is up 128% since then (117% year-to-date) and is just off 29-month highs.

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 14, 2012. Click here to read the entire piece.)

Full disclosure: no positions