(This is an excerpt from an article I originally published on Seeking Alpha on September 20, 2012. Click here to read the entire piece.)

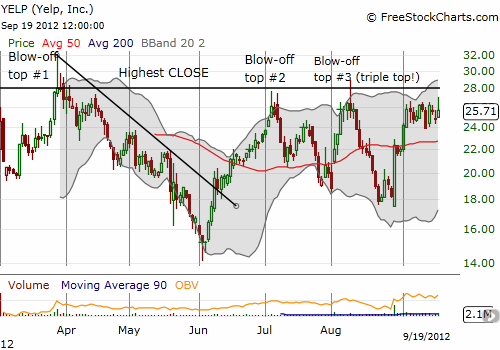

Three weeks ago, I marveled that Yelp.com (YELP) had surged 22.7% on the heels of the lock-up expiration of its IPO but suggested that the rally provided a better risk/reward entry to bet against the stock’s extreme valuation. Since then, YELP has gained another 15%, trading within a wide range for the last two weeks. The extreme skew in implied volatility has also finally settled down from a 2x difference between calls and puts to a more “reasonable” 1.3 (for October expiration). The stock has yet to reverse, but it is now relatively cheaper to buy puts.

However, before plunging into fresh bearish bets on YELP, traders should take a step back and appreciate the opportunities for downside AND upside… {snip}

Source: FreeStockCharts.com

{snip}

In other words, trying to anticipate the next move in YELP is much riskier now than trying to follow the momentum.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 20, 2012. Click here to read the entire piece.)

Full disclosure: long YELP puts