(This is an excerpt from an article I originally published on Seeking Alpha on September 23, 2012. Click here to read the entire piece.)

Over a month ago I wrote that priceline.com (PCLN) was not likely to recover its post-earnings losses in the near-term. Based on the bearish commentary on its European business and reminders about slowing growth rates, I figured PCLN at best would rally to $600 and stop there after hitting resistance at the 200-day moving average (DMA). Instead, PCLN has steadily pressed forward and is now in a breakout position only 6% away from closing the post-earnings gap down.

Source: FreeStockCharts.com

It is also interesting to note that PCLN held support at 2012’s breakout point that ended a year-long trading range. Holding this support makes PCLN’s current run more sustainable.

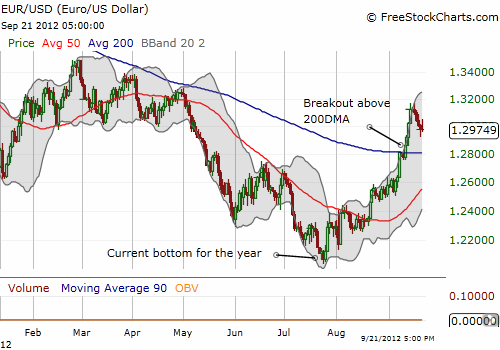

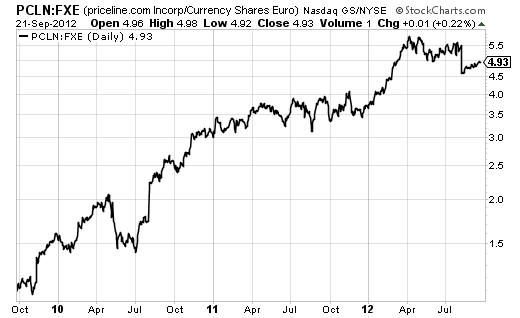

Also interesting is that PCLN’s post-earnings recovery has closely followed the recent recovery in the euro versus the U.S. dollar (FXE). {snip}

Source for above charts: FreeStockCharts.com

Source: StockCharts.com

Going forward, I am assuming PCLN has already turned the corner. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 23, 2012. Click here to read the entire piece.)

Full disclosure: no positions