Earlier in the day, I tweeted:

Finally time to short $USDCAD. At 50DMA and a 2-week post-QE3 relief rally seems “long enough”

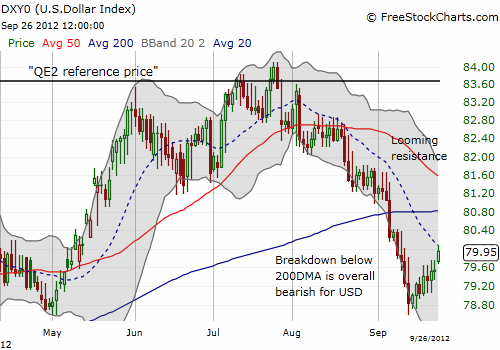

For two weeks since the Federal Reserve announced QE3, the dollar index has had a nice relief rally.

Notice that the dollar index has hit its first test at the 20-day moving average (DMA) which has defined the downtrend since the U.S. dollar failed at the resistance provided by the QE2 price. The QE2 price is defined as the level of the dollar the day before Ben Bernanke telegraphed QE2 at Jackson Hole in 2010. I now expect the dollar to pull back although the path may be as slow and meandering as the previous rise.

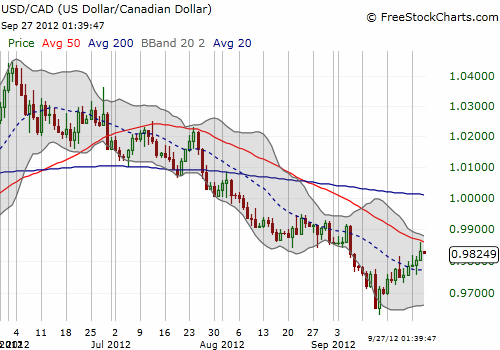

The prospect of a weaker dollar index makes going long the Canadian dollar versus the U.S. dollar more attractive. In fact, it turns out that USD/CAD has hit resistance at the 50DMA.

Source: FreeStockCharts.com

Given I expect the U.S. dollar to meander on its way down, my call to short USD/CAD is a short-term trade. I am expecting a lot of entries and exits as currencies bounce around looking for direction. It may seem counter-intuitive that the U.S. dollar can muster any strength at all. However, in a world of relative attractiveness, the U.S. dollar can look better on some days than others as different kinds of buyers and sellers step in with interests in the stronger U.S. economy, “safe havens”, etc…

(Note well, I am still a bull on the Canadian economy as I explained in November of last year: “Buying Canadian On Expectations for Stronger Growth.”)

Be careful out there!

Full disclosure: short USD/CAD