(This is an excerpt from an article I originally published on Seeking Alpha on August 15, 2012. Click here to read the entire piece.)

The Bank of England’s latest Inflation Report (August 8th) included two items that I found particularly interesting:

- The Bank of England (BoE) expects the squeeze in take home pay in the United Kingdom to finally end. This squeeze was the UK’s longest in almost 100 years.

- Productivity is abnormally low for a recovery, and the BoE is struggling to explain it.

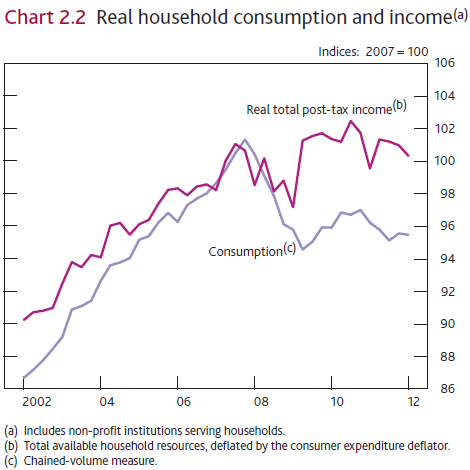

A recovery in take home pay should lead to increased consumption. To date, the stubborn stagnation in income has accompanied a similar stagnation in consumption. Consumption remains near post-recession lows.

Source: Bank of England, Inflation Report, August, 2012 (p7)

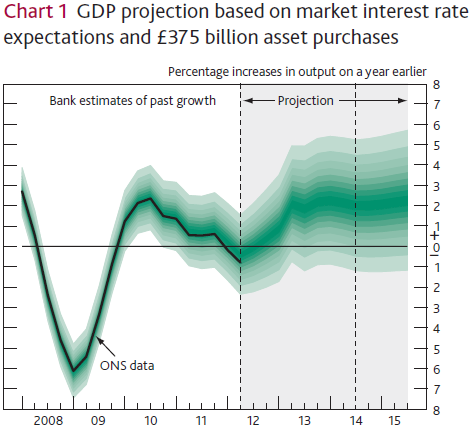

The prospect for a recovery in take home pay is a positive for an otherwise tepid outlook for GDP growth that includes a projection for a return to pre-recesion levels of output only in 2014. {snip}

Source: Bank of England, Inflation Report, August, 2012 (p6)

The recovery in take home pay is arriving on the heels of “puzzlingly robust” employment growth:

{snip}

{snip}

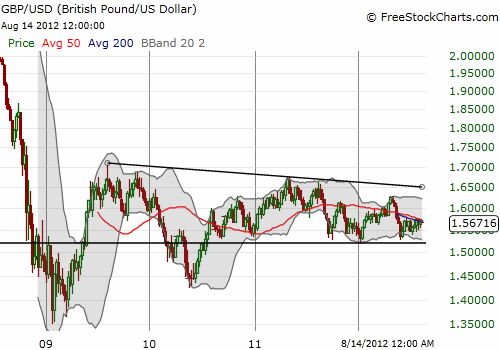

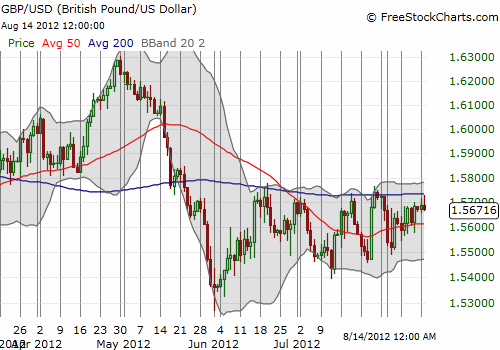

Source for charts: FreeStockCharts.com

Note that at some point, GBP/USD will likely break resistance at the 200DMA and launch another rally toward the top of the extended range. Under this scenario, 1.60 becomes the first trading target.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 15, 2012. Click here to read the entire piece.)

Full disclosure: net long British pound (as of this post)