(This is an excerpt from an article I originally published on Seeking Alpha on August 5, 2012. Click here to read the entire piece.)

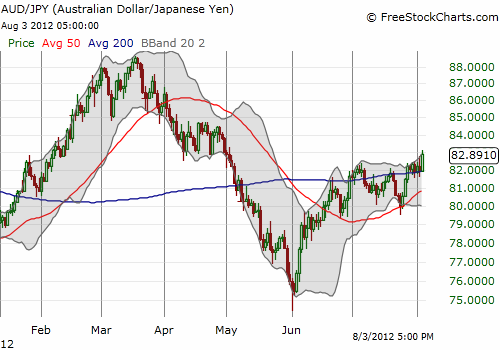

The Japanese yen was the last remaining currency to “hold out” against the Australian dollar’s recent advances. On Friday, the AUD/JPY currency pair jumped again off its 200-day moving average (DMA) and this time set a fresh three month high.

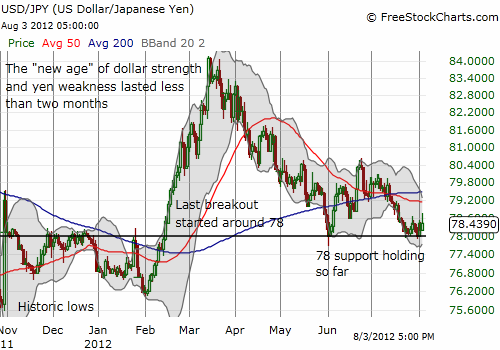

The AUD/JPY cross was also my last “hiding spot” for a bearish position against the Australian dollar despite the looming potential for intervention to weaken the yen. I think as long as the U.S. dollar can hold above 78 versus the Japanese yen (FXY), I think Japanese Finance Minister Jun Azumi will keep the dogs at bay. Seventy-eight has become an important line of support.

Once (if?) the Australian dollar follows through on its latest breakout, I will have to back down from my short AUD/JPY position. {snip}

The Australian dollar’s stubborn strength has motivated me to pay even more attention to the economic numbers coming out of the country. It is very possible that I have simply been overly bearish…{snip}

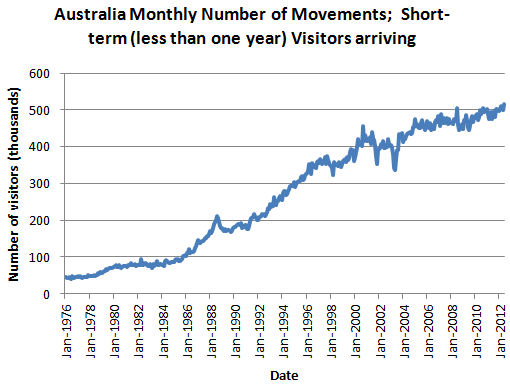

The strong Australian dollar has also not deterred tourists. {snip}

Source: Australia Bureau of Statistics

{snip}

{snip}…The host noted that Australia is one of a shrinking number of countries with triple-A rated government debt. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 5, 2012. Click here to read the entire piece.)

Full disclosure: short AUD/JPY, long USD/JPY, long BHP