(This is an excerpt from an article I originally published on Seeking Alpha on July 30, 2012. Click here to read the entire piece.)

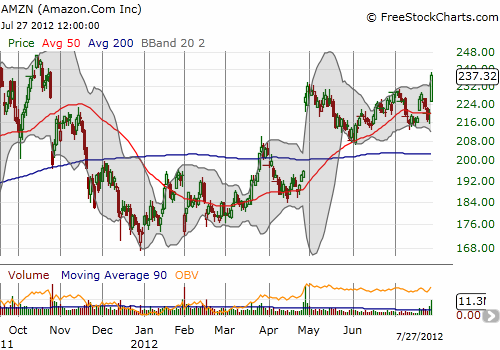

For the second earnings cycle in a row, I failed to execute the post-earnings trading strategy for Amazon.com (AMZN) to buy the open (see “After Amazon.com Earnings, Buy The Stock At The Opening Price” for more details). After the April earnings report, AMZN soared a surprising 16%, and I thought it was just prudent to wait for a dip to buy the stock. Unfortunately, no significant dip occurred on that day after earnings. AMZN spent the rest of the quarter flipping around the $219 bear/bull dividing line (the low of the day following earnings), and I attempted very few trades.

In the July earnings report last week, I had absolutely no excuse to miss the trade. Although I could perhaps be excused for standing frozen in amazement that AMZN could soar yet again on what on the surface sure looks like poor results. As usual, what first catches my eye with AMZN is the small amount of income the company makes on sizeable revenue:

{snip}

Whoever is accumulating AMZN shares continues to pursue his (or their) strategy in a very aggressive manner after earnings reports. {snip}

Source: FreeStockCharts.com

The window for the post-earnings trade in AMZN lasts for two weeks. {snip}

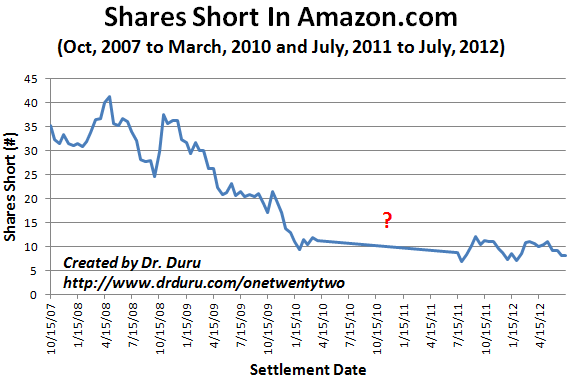

Interestingly, bears remain a very small part of the story in trading AMZN. {snip}

Source: NASDAQ.com short interest

I conclude with some notes from scanning the Seeking Alpha transcripts of the AMZN earnings call…{snip}

In other words, AMZN has not YET figured out how to implement same-day delivery across its markets. It seems very likely the company will do so in select markets…wherever it makes sense economically. Once that happens, I highly anticipate AMZN will further refine its logistics expertise in an effort to broaden its capabilities. This is not a story for the next few quarters but instead the next few years. Stay tuned.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 30, 2012. Click here to read the entire piece.)

Full disclosure: no positions