(This is an excerpt from an article I originally published on Seeking Alpha on August 2, 2012. Click here to read the entire piece.)

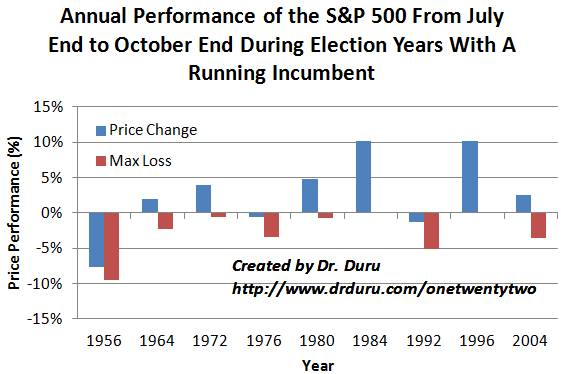

A month ago I explained how the three months leading into a U.S. Presidential election featuring an incumbent tend to represent a bullish period (see “The Positive Trade When Incumbent Presidents Run For Re-Election“). While I provided the graphs showing the tempting upside opportunities on the S&P 500 (SPY), I neglected to include the risk of drawdowns. It turns out the the this bullish period also features very mild sell-offs, especially relative to the typical turbulence the stock market faces between August and October.

{snip}

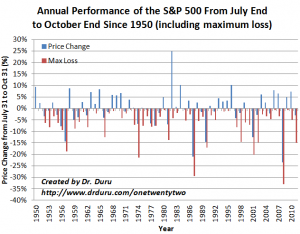

Annual Performance of the S&P 500 From July End to October End Since 1950 (including maximum drawdown or loss)

- average gain: 0.09%

- median gain: 0.20%

- average drawdown: -6.37%

- median drawdown: -4.29%

{snip}

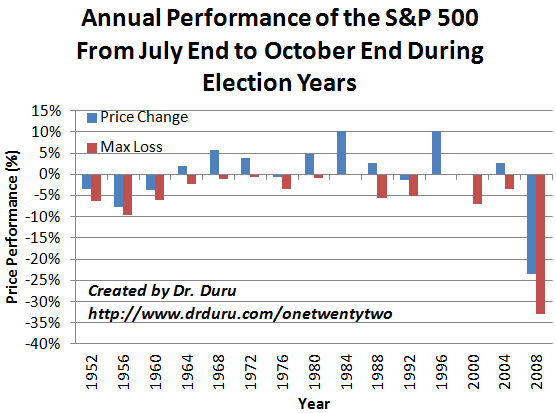

Annual Performance of the S&P 500 From July End to October End During Election Years

- average gain: 0.11%

- median gain: 2.02%

- average drawdown: -5.60%

- median drawdown: -3.49%

{snip}

Annual Performance of the S&P 500 From July End to October End During Election Years With A Running Incumbent

- average gain: 2.69%

- median gain: 2.59%

- average drawdown: -2.78%

- median drawdown: -2.24%

Source: Dates for elections from wikipedia, prices from Yahoo!Finance

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 2, 2012. Click here to read the entire piece.)

Full disclosure: long SDS, long SSO puts