(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 71.8% (first day of FOURTH overbought period in five weeks)

VIX Status: 15.6

General (Short-term) Trading Call: No new bearish trades until S&P 500 hits next resistance (at 1416)

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

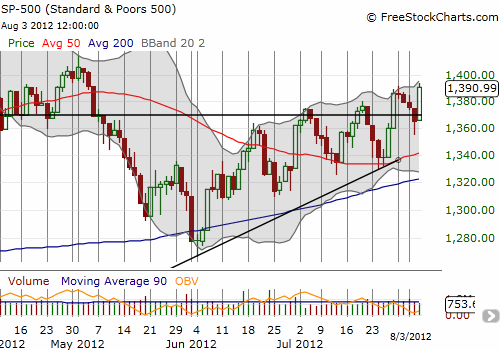

The S&P 500 surged 1.9% to make a marginal new 3-month high. It took T2108 from 59% into overbought territory in a flash. This is the FOURTH overbought period in just the last 5 weeks. The S&P 500 is up 8.8% since the June lows. This is the fourth higher high in this period, each one preceded by a higher low. Yes, believe it or not, an incipient rally is creeping along and it is difficult to notice because the sharp plunges following the rallies are equally numerous.

However, there is one key, simple difference in this phase. The higher low that served as the fuel for this latest surge did NOT reach any natural support. This is a sign of gaining strength for this rally; that is, sellers lost control earlier than usual. The flip side is that buyers have a higher bar to maintain to keep the primary uptrend going.

With the rally gaining momentum, I am also raising the bar for initiating a fresh round of bearish positions (mainly SSO puts). Now that the S&P 500 has again surged away from the 2011 high, next resistance is between the May closing high around 1406 and intraday high around 1415. That day, May 1st, was a picture-perfect failure at the 2012 high (and multi-year high) from April. So, a breakout and close above the May high will likely be very bullish.

Another reason I am raising the bar is that the market is now in a bullish season. I explained my rationale for expecting a sustained rally in the July 27th T2108 Update. In the August 1st T2108 Update, I reminded us of the multi-year bullish trend in the S&P 500 that shows each panic generated from the European sovereign debt crisis has printed a higher low. On August 2nd, I updated my analysis of the three months preceding a Presidential election to include maximum drawdowns. Not only is this period firmly bullish when an incumbent is running for re-election, but also the maximum drawdowns are quite mild, especially for a period that is generally prone to massive sell-offs. From that analysis, I am now switching to a “buy the dips” mentality. I recognize this approach will get tricky if (once?) T2108 goes into an extended overbought period. However, this approach is really just the natural complement to my previous fade the overbought rally trades using the T2108 rules. Both strategies have worked well for the nimble in this grinding rally from the June lows. In other words, I am swinging with the trend instead of against it.

I was fortunate to sell the bulk of my SSO puts into the selling on Thursday (apologies to anyone not following my trades on twitter – you read my T2108 Update too late to close out any bearish positions as Friday’s rally likely gave you little time to scramble out of the way!). The Friday expiration put an extra sense of urgency into the trade. My handful of puts expiring in two weeks will likely go out worthless. For now, I am maintaining my hedge using SDS. At some point soon, I will likely switch that out to Active Bear ETF (HDGE), a much better long-term approach to hedging a bullish portfolio. I am also still holding onto VXX shares that are draped by short VXX calls and puts. This approach mutes the downside pain while giving me a modicum of “sleep well at night” protection in case something calamitous somehow happens between trading sessions.

In Thursday’s T2108 Update, I noted the oddity of the plunge in volatility (VIX) even though the stock market was generally weak. I used that observation to suggest that whatever the outcome of Friday’s unemployment report the market’s response would be muted (to the downside). My intrigue and interest in the potential relationship has taken a quantum leap upwards now that I see how that oddity seems to have been far more bullish than I could have imagined at the time. Stay tuned!

Finally, my HUGE disappointment for the week is not having my “contrary” europanic position in play for Friday’s rally. I felt fortunate to sell Siemens Atkins (SI) when it hit the wall at the top of the previous trading range on Wednesday, August 1st. However, I failed to take another bite on Thursday’s close when SI settled in at the 2010 support. The result is a miss on a monster 7.4% gain. SI is now right at the top of my “buy the dip” list, and I will be much more aggressive going forward with it. Next resistance at the 200DMA, and the previous trading range, the 50DMA, and the 2010 support line should all become very firm supports going forward.

Daily T2108 vs the S&P 500

Click chart for extended view with S&P 500 fully scaled vertically (updated at least once a week)

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS; long SSO puts; long VXX shares, calls, and puts; short VXX calls