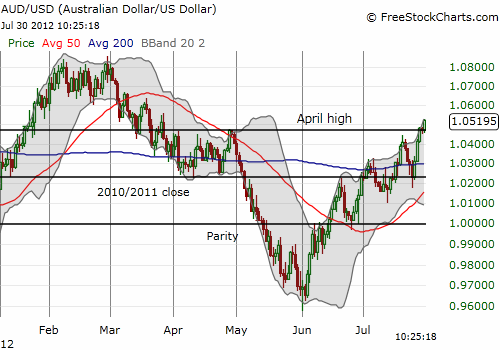

The Australian dollar is now at 4-month highs versus the U.S. dollar (FXA). In what now looks like a clean breakout, the AUD/USD currency pair has hurdled over the latest resistance level which was the April high.

Source: FreeStockCharts.com

While I continue to believe the Australian dollar has a big sell-off ahead of it once more economic data rolls out and/or the RBA speaks out on monetary policy again, it no longer makes sense to fight against this surge (although fading the peaks likely still makes sense for short-term trades back toward the uptrend line). The carry trade that has featured selling low to zero rate currencies to purchase the Aussie has been the bigger and badder force in play these last several weeks. It is better to wait for renewed signs of weakness before resuming a bearish position. This week, the evening of August 1st, Australia reports retail sales. I will wait for that report before making the needed adjustments in my positioning. It should be a VERY volatile day given the Federal Reserve will make its latest announcement on monetary policy earlier in the day. Moreover, the ECB and the Bank of England roll out their own monetary policy statements the following morning!

Be careful out there!

Full disclosure: net bearish Australian dollar