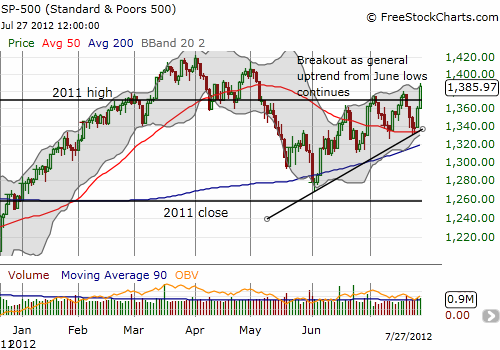

(This is an addendum to the last T2108 Update that presented the case for an imminent, extended, overbought rally for the S&P 500).

On Friday, July 27, the S&P 500 broke out in a rally that continues in grinding fashion from the June lows.

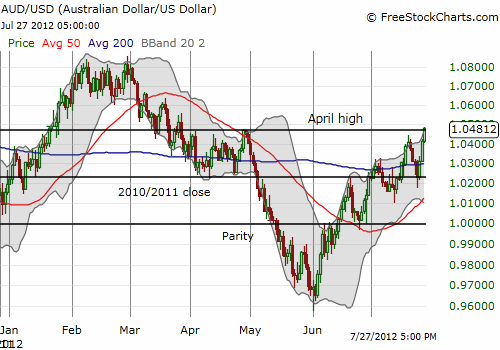

In parallel, the Australian dollar (FXA) has also rallied from its June lows against the U.S. dollar (AUD/USD). Same higher highs. Same higher lows. The Australian dollar has broken out to a four month high that essentially confirms the breakout on the S&P 500.

Source for charts: FreeStockCharts.com

Ever since the Australian dollar hit my post June-low target of parity with the U.S. dollar, I have written bearishly about the Australian dollar. Just as the S&P 500’s rally is sometimes hard to believe, the Aussie’s continued rally has been quite surprising. At some point soon, I will likely need to suspend my disbelief and put to rest my bearish positioning against the Australian dollar. The first step of that suspension would be follow-through to this breakout. After that, I will be waiting to hear what kind of jawboning the Reserve Bank of Australia (RBA) exercises to try to push its currency back down. Stay tuned..!

Be careful out there!

Full disclosure: net bearish Australian dollar, long SDS and SSO puts