(This is an excerpt from an article I originally published on Seeking Alpha on July 22, 2012. Click here to read the entire piece.)

With an increasingly dour macro-economic backdrop, one might expect a very large response to Apple’s July earnings report {snip}… However, the trading action going into Tuesday evening’s earnings report was very lukewarm until today (Monday, July 23). Unlike the April earnings where the data gave me extreme confidence in a large upside response, the trading going into July earnings is not yet producing clarity. Indeed, this time around, I will likely need to wait until the hours or minutes before the close preceding earnings to make a final decision. {snip}

In the rest of this piece, I describe the factors I am considering. Please reference the previous Apple earnings play analysis, “Odds Favor A Big One-Day Upside After Apple Posts Earnings“, for more background and related charts.

{snip}

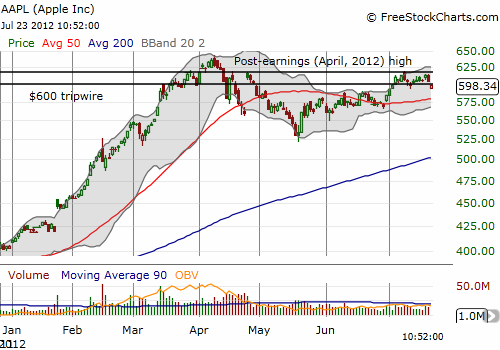

Source: FreeStockCharts.com

{snip}

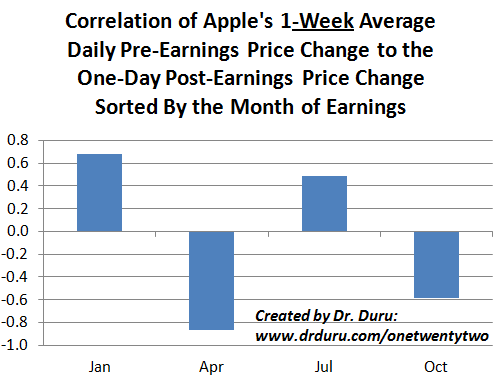

Recall that the two overall lessons from the analysis of the Apple earnings play are that 1) AAPL produces distinct patterns based on the quarter of the earnings report, and 2) the overall correlations have changed since 2010. {snip}

So, it seems the Apple earnings play essentially hinges on the final two days before the report. Here are the scenarios that will define my decision:

- If Apple closes within the trading range ahead of earnings, I will not play earnings. I will instead focus on potential post-earnings plays.

- If Apple closes above or below the trading range ahead of earnings, I will assume the odds favor the positive correlation with the 2-week daily average. Specifically, a close below $600 makes me bearish, and a close above $620 makes me bullish.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 22, 2012. Click here to read the entire piece.)

Full disclosure: no positions