(This is an excerpt from an article I originally published on Seeking Alpha on July 9, 2012. Click here to read the entire piece.)

Almost a month ago, John C. Ashburn, Executive Vice President & General Counsel of Molycorp (MCP) purchased $101,300 worth of MCP stock. This purchased converted him from an insider seller during 2011 around $50/share into a buyer at $20.26. {snip}

Source: FreeStockCharts.com

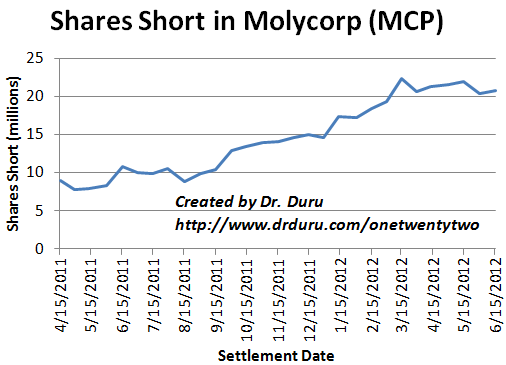

Ashburn has an extensive history with Molycorp and its predecessor corporate entities, so I have some confidence in his investment signal…{snip}…At least short interest has finally stopped increasing. However, at 38.8% of float, shorts are clearly not impressed by anything happening at MCP.

Source: NASDAQ.com Short Interest

A big moment of truth is soon approaching for MCP with the scheduled Q4 completion of Phases 1 and 2 of Project Phoenix, the company’s “expansion and modernization project.” {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 9, 2012. Click here to read the entire piece.)

Full disclosure: long MCP shares, calls, and puts; short MCP calls; long MCP-PA (preferred)