(This is an excerpt from an article I originally published on Seeking Alpha on July 9, 2012. Click here to read the entire piece.)

Five months ago, I recommended Dynex (DX) as another play on a housing recovery (and bottom for 2013). The rationale was relatively straightforward:

{snip}

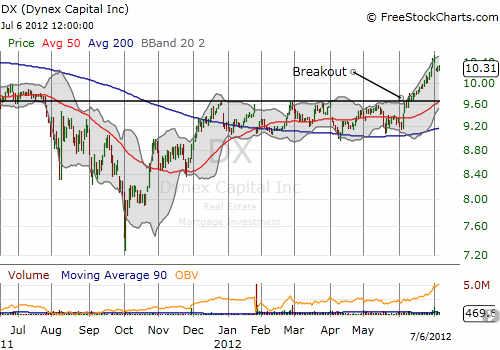

Since then, DX has managed to tack on 12% and now sits at 15-month highs (and 6.9% away from all-time highs). Nearly all these gains have come since early June as the stock has broken out.

Source: FreeStockCharts.com

I think DX now sits at the nexus of some positively converging trends:

{snip}

Dynex Capital is a stock that can still be bought on dips, and I am holding for the long-term.

For another alternative for investing in the housing recovery see “Vertical Capital Income Fund Offers Attractive Alternative for Investing In Mortgages.”

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 9, 2012. Click here to read the entire piece.)

Full disclosure: long DX