(This is an excerpt from an article I originally published on Seeking Alpha on June 22, 2012. Click here to read the entire piece.)

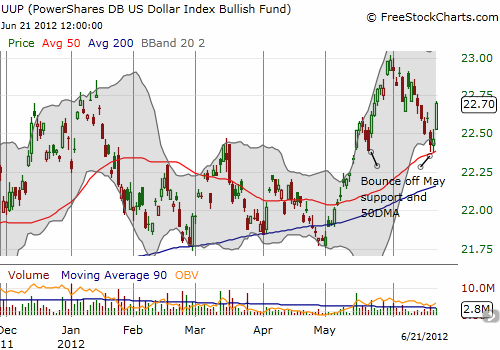

Thursday was a good day for the dollar index (UUP) as it experienced one of its strongest one-day rallies of the year. {snip}

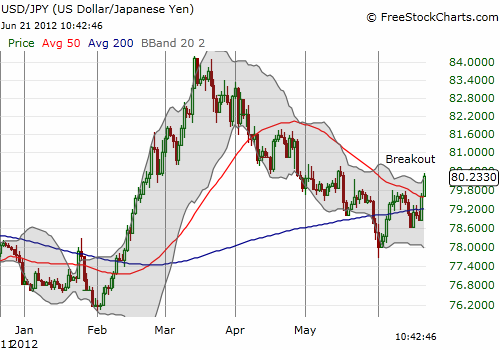

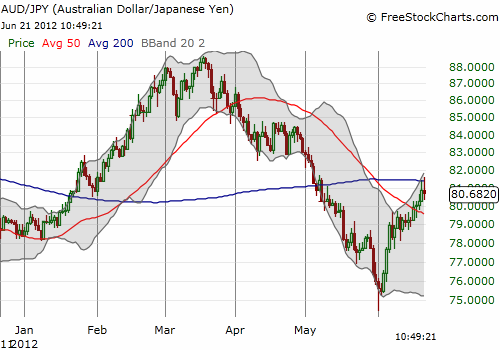

While the dollar’s rally was indeed impressive, I think the Japanese yen is an even more interesting story. The yen sits at the cusp of renewed risk aversion. The traditional safe haven of paper currencies sits at one of those critical junctures that likely separates sustained weakness from an important reversal…{snip}…a U.S. dollar rally from current levels must certainly confirm risk aversion.

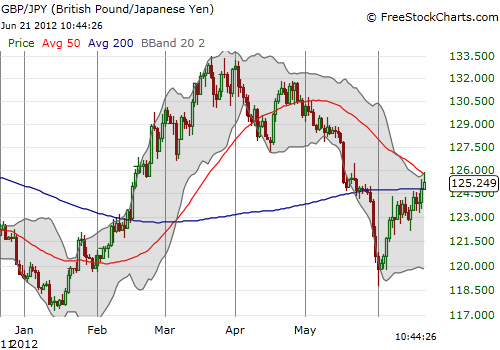

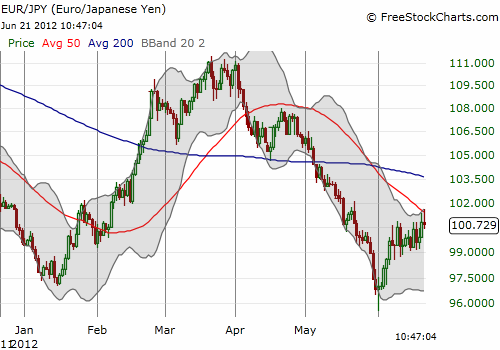

The following charts show that the U.S. dollar is breaking out against the yen (FXY) with a run over the 50DMA, but other major currencies are fading neatly from resistance against the yen.

For now, I am maintaining my bullish stance on the Japanese yen, and I increased that position today. A failure of this position will have me switch to an emphasis on a bullish dollar position. {snip}

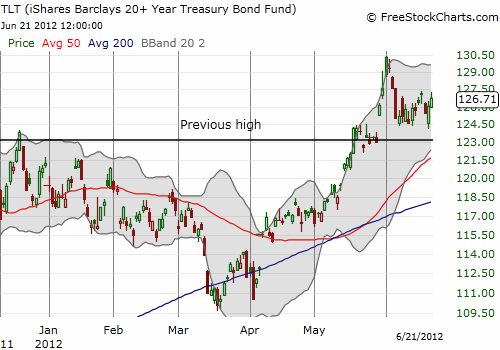

The iShares Barclays 20+ Year Treasury Bond (TLT) continued its bounce…{snip}

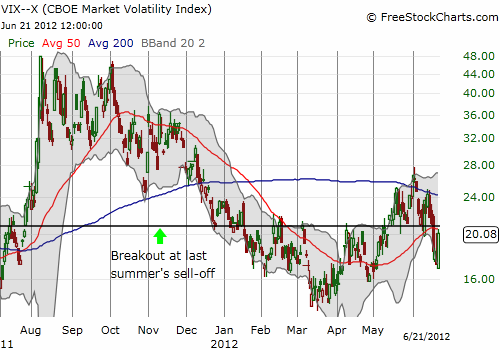

Finally, the volatility index, the VIX, surged an amazing 16%…{snip}

{snip}

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 22, 2012. Click here to read the entire piece.)

Full disclosure: net long Japanese yen, net short U.S. dollar, net long VXX