(This is an excerpt from an article I originally published on Seeking Alpha on June 11, 2012. Click here to read the entire piece.)

Now that the stock market seems set to continue next week’s rally thanks to the multi-billion bailout of Spain’s banks, it makes sense to consider (or review) hedges for the summer and beyond.

A friend recently made me aware of the Active Bear ETF (HDGE), an actively managed bearish ETF… {snip}

On the fundamental side, HDGE looks for companies that use aggressive revenue recognition by pulling revenue forward to meet earnings guidance. {snip}

{snip}

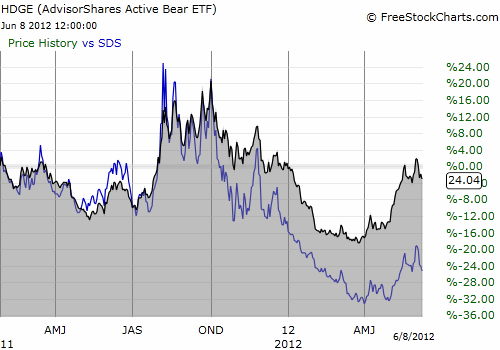

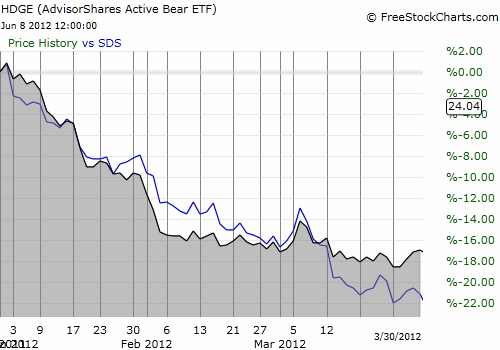

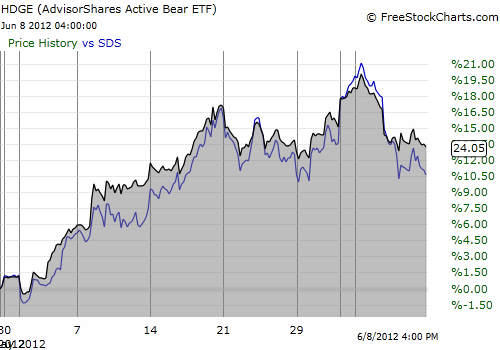

The following charts demonstrate these differences over multiple timeframes. The shaded area with the black border represents HDGE, and the blue line represents SDS.

First of all, HDGE has clearly out-performed SDS since inception.

{snip}

During most of the sell-off in May, HDGE maintained a small advantage that was surprisingly lost (marginally) at the very peak of the sell-off.

Source for charts: FreeStockCharts.com

I was fascinated to discover that while HDGE does not use leverage or derivatives, it behaves as if it does when compared to a leveraged fund like SDS in the short-term. Overall, it appears HDGE is a no-brainer over the longer-term given the corrosive performance of leveraged ETFs over time. {snip}

For the short-term, SDS seems as good a bet, if not better at times, than HDGE. Moreover, over these shorter timeframes, using HDGE doubles the risks of active management (HDGE’s AND yours!).

Be careful out there!

(Note that my friend was the source of most of the ideas for how to compare HDGE’s performance).

(This is an excerpt from an article I originally published on Seeking Alpha on June 11, 2012. Click here to read the entire piece.)

Full disclosure: long SDS