(This is an excerpt from an article I originally published on Seeking Alpha on June 6, 2012. Click here to read the entire piece.)

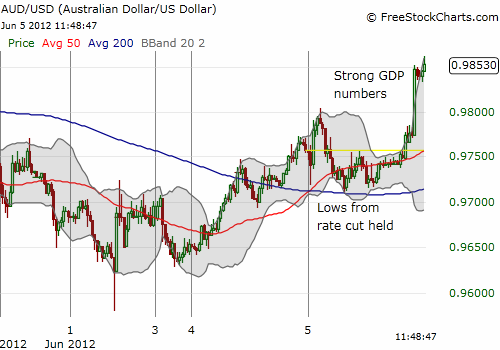

Tuesday night, the Australian Bureau of Statistics (ABS) reported a surprise jump in GDP of 1.3% quarter-over-quarter. With growing fears of a global economic slowdown, analyst consensus had pegged growth only around 0.6%. At the same time growth surprised to the upside, Australia’s terms of trade plunged 4.3% accompanying a -0.5% (percentage points) contribution to GDP of net exports. The Reserve Bank of Australia (RBA) will certainly take careful note of these numbers since robust domestic demand coupled with a trade deficit funded by a depreciating currency could reintroduce inflationary pressures into the economy. {snip}

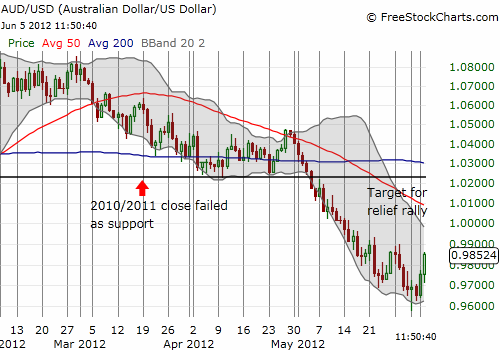

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 6, 2012. Click here to read the entire piece.)

Full disclosure: net long Australian dollar