(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 26.2% (Terminates previous oversold period at 3 days)

VIX Status: 22.2

General (Short-term) Trading Call: Take some profits from bullish positions, otherwise hold (click here for a trading summary posted on twitter)

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

Yesterday, I wrote “make or break time for a relief rally“:

“…the ingredients remain active for a decent oversold rally. I added to my SSO calls on Tuesday and also bought VXX calls as a small hedge. The bounce off the 200DMA could be sharp as shorts rush to cover, disappointed at the lack of follow-through on Friday’s nasty close below the 200DMA. However, if/once the S&P 500 breaks Monday’s low at 1267, the index will likely confirm for us that yet another sell-off summer is at hand. In other words, this is essentially make or break time for a relief rally.”

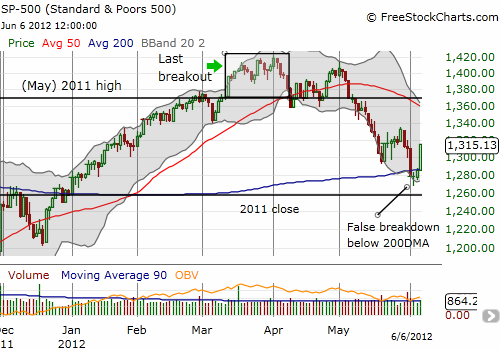

Wednesday turned out to be “make time” as the rally for the S&P 500 was indeed sharp. The bounce out of oversold conditions demonstrated once again the power of oversold and the benefit of following trading rules and trading with the odds. The 2.3% jump in the index was just about as good as I could expect; the index even erased all its losses from Friday’s reaction to the latest U.S. jobs numbers – and then some. As a result, I sold 2/3 of my SSO calls (but I held onto the VXX hedge). I expect a little follow through by the close of this week and plan to empty my remaining coffers of SSO calls by then.

The S&P 500’s false breakdown below the 200DMA provides a great dividing line between a bullish and bearish trading bias (short-term). As long as the index remains above the 200DMA, and below resistance levels, trading bullishly is the better risk/reward play. There is no need to get overly bearish again until sellers manage to break through to new lows below the 200DMA. In the meantime, you can expect bears and shorts who overplayed the negativity from Friday to continue to scramble to cover. I will hold my recommendation for fading at resistance until the S&P 500 trades that far, and I know where T2108 stands. The perfect fade is always an overbought T2108 and a S&P 500 at resistance, but I cannot imagine such a scenario for quite some time. For a more comprehensive review of my trading outlook, see the T2108 Update for June 1st: “Oversold Again; What To Expect Going Forward.”

The VIX added to the intrigue again as it plunged 10%. It is now another 4.5% drop away from the critical support line of 21. If the VIX manages to break through 21 in convincing fashion, I will have to get more bullish – even with the 50DMA now turning upward.

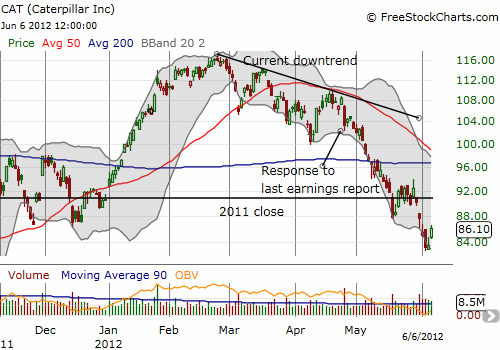

My favorite canary Caterpillar (CAT) has not followed the S&P 500’s bullish trailblazing. Even though CAT gained 3.6% today, the stock only made a marginal new intraday high for the week. Moreover, CAT remains in the red for the year and lags the S&P 500. Cousin Terex (TEX) put on a much more spirited rally with an 11% gain right into the 200DMA. Volume surged to over twice the 90-day moving average – quite impressive and a warning sign to me that if I go after the stock again with a bearish bet, I better develop some extraordinarily strong reasons.

Other stocks of technical interest are Joy Global (JOY) and JPMorgan Chase (JPM). JOY is a canary for commodities. The stock has now almost closed its post-earning gap from last week and is above the lows from 2011. JPM has rallied back to flatline for the year and now needs to follow-through with volume.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS, long SSO calls, long VXX calls