(This is an excerpt from an article I originally published on Seeking Alpha on June 1, 2012. Click here to read the entire piece.)

On Tuesday, May 29, I described a trade on Joy Global (JOY) earnings featuring a bullish bias with a hedge. {snip}

JOY ended up disappointing investors… {snip}… Investors and traders clearly found little solace in JOY’s expectation that the Chinese government will ease loan requirements and start spending more. {snip}

I closed the put spread and will end up with a small profit no matter what happens to the calls I am still holding… {snip} …The irony here is that the spread only marginally reduced the cost of the bearish side of this bet. I learned a strong lesson in being “too cheap.”

The biggest lesson from this experience is that context can matter a lot for earnings plays. If I had mechanically applied my standard analysis and rules for earnings plays, I would have only bet on upside (albeit in a much more conservative way, like a call spread). {snip} The large swings ahead of earnings tipped me off from a qualitative standpoint; from a quantitative perspective I now need to add a study of pre-earnings volatility (or price RANGE not just average change). {snip}

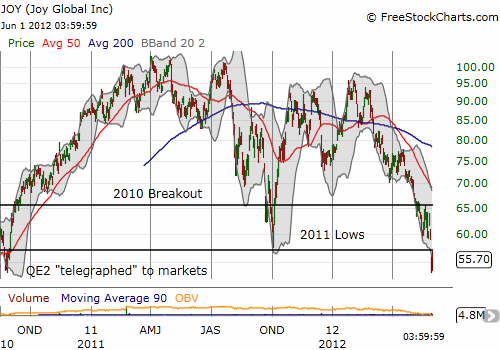

Source: FreeStockCharts.com

Finally, the large price range in JOY’s post-earnings trading has also taught me that I need to include a quantitative study of post-earnings lows and highs, not just the close, when correlating to previous price history. {snip} JOY demonstrates that it is probably also useful to understand the correlation between maximum potential gains/losses and previous history. Stay tuned for the next round of earnings analysis…

Until then…be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 1, 2012. Click here to read the entire piece.)

Full disclosure: still long JOY calls