(This is an excerpt from an article I originally published on Seeking Alpha on May 31, 2012. Click here to read the entire piece.)

{snip} Since a spate of heavy call buying in February, short interest has taken a fresh plunge. It has now returned to levels last seen right before foreclosuregate exploded.

Source: NASDAQ.com LPS Short Interest

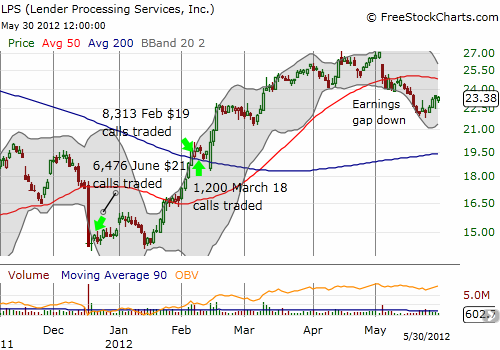

The chart below demonstrates the prescience of recent call option buyers. I am guessing that a lot of short covering has helped LPS gain 55% for 2012.

Source: FreeStockCharts.com

Although LPS has lost 13.5% since reporting earnings May 3rd, short interest continued to decline. I consider this more confirmation that the negative headwinds for LPS continue to abate. Indeed, in the last earnings conference call (see Seeking Alpha transcripts), LPS’s management executed as well as can be expected. {snip}

{snip}

Here are a few of the highlights from the earnings conference call that caught my interest {snip}:

{snip}

With a forward P/E of 8.8, price-to-sales ratio of 0.96, price-to-book is 3.7, and 1.7% dividend yield, LPS is not expensive but also not particularly cheap. I suspect the loss in the stock since the last earnings report is a combination of profit-taking and the malaise in the general stock market. I am expecting the stock to remain in a trading range for some time until a fresh catalyst appears; short-covering is not likely to provide much more lift going forward. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 31, 2012. Click here to read the entire piece.)

Full disclosure: long LPS

Ah, LPS – their ‘technology’ amounts to nothing more than sweatshops full of robo-tards helping to hold down the homeowners while the banks fee-rape them before foreclosure. LPS is the banks whore, doing whatever dirty job the banks want a little distance from. Phony docs. phony titles, phony appraisals, LPS is right in there with its greedy paw out for more bank $. Like all whores, though, its days are numbered.