(This is an excerpt from an article I originally published on Seeking Alpha on May 15, 2012. Click here to read the entire piece.)

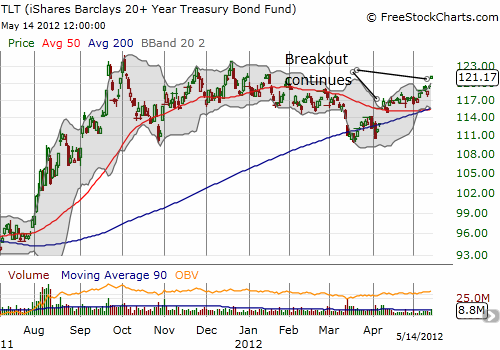

So much for that bottoming process in ProShares UltraShort 20+ Year Treasury (TBT) that I noted two months ago (see “Looking Like A Bottom For TBT“). Interest rates are headed lower again on U.S. Treasurys. This has occurred despite common and often-stated expectations earlier this year that stronger economic data in the U.S. would slowly but surely lead to higher rates. It was against this backdrop I blithely assumed the bottom was finally in for TBT. Now, TBT is breaking down, and iShares Barclays 20+ Year Treas Bond (TLT) is breaking out.

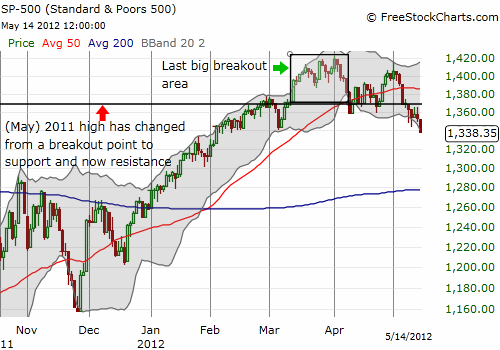

The prospects for reversing these moves seem relatively dim as a steadily rising U.S. dollar index accompanied by a sinking S&P 500 seem to both confirm the growing momentum in fear. {snip}

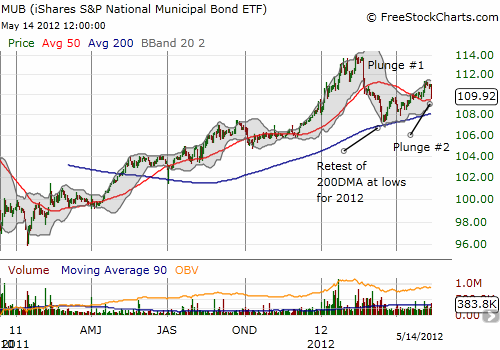

Finally, it seems increasingly clear that munis will NOT be the rock of choice for fearful investors to use for hiding. {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 15, 2012. Click here to read the entire piece.)

Full disclosure: long TBT, SDS, SSO calls