(This is an excerpt from an article I originally published on Seeking Alpha on May 15, 2012. Click here to read the entire piece.)

The Financial Times has launched a new weekly podcast called “Hard Currency.” The first interview aired on May 13th featuring Alice Ross as host and senior currency analyst Paul Robson from the World Bank of Scotland. It provided a concise, digestible, and balanced analysis of currency markets in ten minutes. I think this series has a lot of promise as a quick warm-up for a week of trading, and I will be checking in on it regularly.

Here are a few (teaser) highlights from this week’s interview followed by my own commentary:

{snip}

I had not considered the impact of capital flows back into the eurozone by banks forced to bring money home..,{snip}

Robson seems to agree with my view that the RBA is not likely to drop rates much further than current levels…{snip}

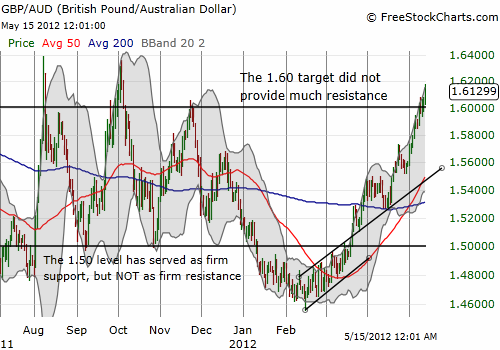

The attraction of using the British pound against the Australian dollar is that the pound is currently the “flavor of the year” with more and more traders assuming the U.K. offers a currency safehaven because of its current austerity program to rein in the budget. {snip}

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 15, 2012. Click here to read the entire piece.)

Full disclosure: long EUR/CHF, long EUR/GBP, long GBP/AUD, long AUD/USD. long AUD/JPY, long AUD/CHF, short EUR/JPY, long USD/JPY, short USD/CHF, short USD/CAD, short GBP/USD, long GBP/JPY (note well that this portfolio represents layered hedges and mostly short-term trades)