(This is an excerpt from an article I originally published on Seeking Alpha on May 13, 2012. Click here to read the entire piece.)

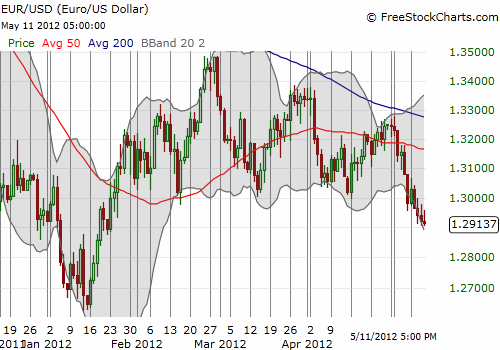

The market has spoken in response to the changing political tide in Europe, and the market is apparently not thrilled. The euro slid almost the entire week against the U.S. dollar, ending the week at fresh four month lows.

Two months ago, I wrote “Nassim Taleb Likes Euros And So Should You.” I believe Taleb’s fundamental premise is that the EU has (or is) addressing its debt problems in a way that will provide future support and strength for the currency. French President-elect Francois Hollande will likely throw a wrench in Taleb’s assessments as he is likely to increase the debt in order to fund pro-growth initiatives. {snip}

{snip}

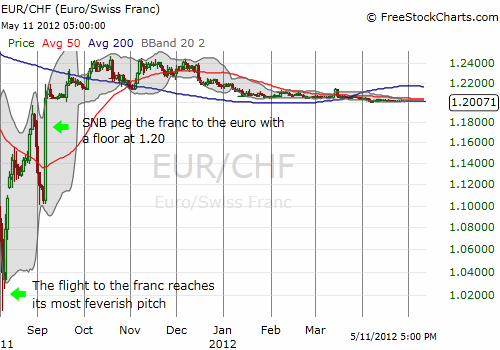

To me, the big wildcard in foreign exchange is the Swiss National Bank (SNB) and capital flows in and out of Switzerland. As the euro presumably continues to weaken, will the SNB be able to continue supporting the 1.20 floor against the euro (EUR/CHF)? {snip}

At some point soon, I will become net long the Swiss Franc, primarily against the U.S. dollar. {snip}

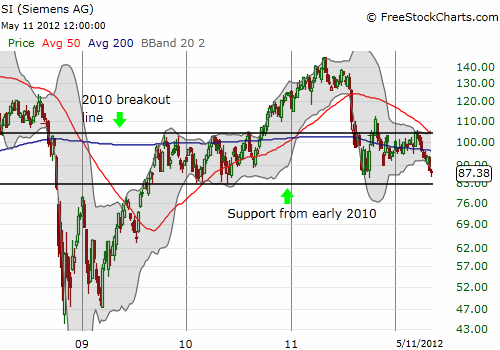

Finally, as the euro sinks and pressures mount for pro-growth initiatives, I get more and more interested in eurozone stocks, especially those in the German industrial sector. {snip}

Source for all charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 13, 2012. Click here to read the entire piece.)

Full disclosure: long FXF, short EUR/USD, long EUR/CHF, long AUD/CHF, short USD/CHF, long EUR/GBP, short EUR/JPY