(This is an excerpt from an article I originally published on Seeking Alpha on May 11, 2012. Click here to read the entire piece.)

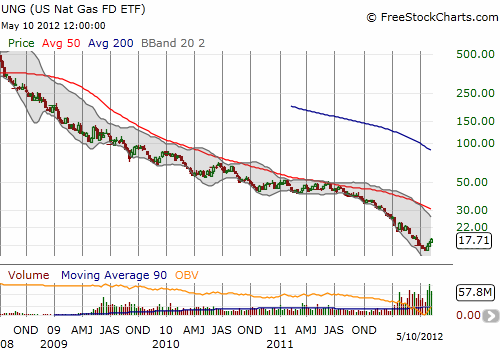

On April 19th, natural gas (UNG) reached a 10-year low at $1.907/mmBtu. This week, natural gas traded to a two-month high, the largest and longest-lasting move higher in a very, long time. Dow Jones Newswire explained the rise by pointing to an Energy Industry Administration (EIA) forecast that utility demand for natural gas will jump 21% this year. Utilities with natural gas capacity will make the switch from much pricier coal (see “US GAS: Rally On Utility Demand Boosts Price To 2-Month High“). However, I also think recent news about exports of liquified natural gas (LNG) are helping to provide a firmer floor here.

On May 6, The Financial Times reported that Japan has boosted imports of LNG to replace lost nuclear power. {snip}

On May 7, Cheniere Energy Inc. (LNG) sold nearly $500M in stock to finance a natural-gas export terminal in Louisiana (see “Cheniere to sell $470 mln in stock at discount“). I interpret this move as a signal that more cheap U.S. natural gas will get exported, providing a conduit of increasing demand that should help provide a price floor. The news from the U.K. simply confirmed that the export market is healthy.

{snip}

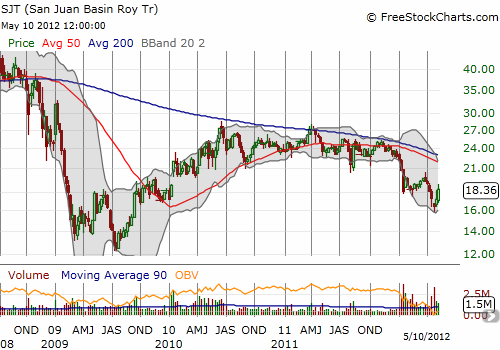

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 11, 2012. Click here to read the entire piece.)

Full disclosure: long SJT, ECA