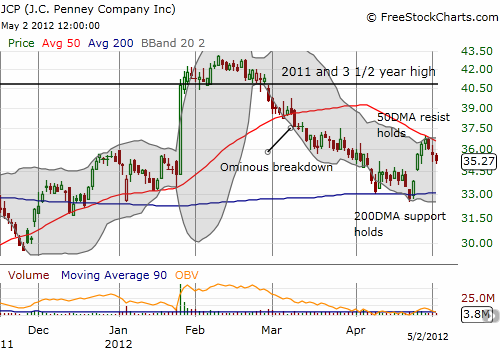

I last wrote about J.C. Penney (JCP) in March right after an ominous breakdown below its 50-day moving average (DMA) (see “Put Buyers Rush Into J.C. Penney As The Stock Breaks Down“). I soon joined the surge of put volume that occurred around that time, and the trade ended well. JCP eventually erased all its gains from the surge on January 26, 2012 but also found critical support, twice, at its 200DMA. The second retest preceded an impressive 10% bounce which ended with pinpoint accuracy at the 50DMA…now serving as resistance.

Source: FreeStockCharts.com

As earnings approache May 15th, short interest has ramped to its highest level since last September. As of April 13th, 35.4M shares of JCP are sold short. This represents 25% of the float. At the same time, the put/call ratio has plummeted. According to Schaeffer’s Investment Research, the open interest put/call ratio has dropped to 0.77, almost the lowest point in a year. Over the past two years, similar levels have preceded major rallies in JCP except once. The open interest put/call ratio briefly dropped to 0.60 before the 19% gain on January 26th.

While it is definitely possible shorts in JCP are rushing to call options to hedge their bets, I am definitely no longer interested in buying puts!

Be careful out there!

Full disclosure: no positions