(This is an excerpt from an article I originally published on Seeking Alpha on April 27, 2012. Click here to read the entire piece.)

Ahead of Apple’s (AAPL) earnings on Tuesday, April 24, I wrote the following {snip}

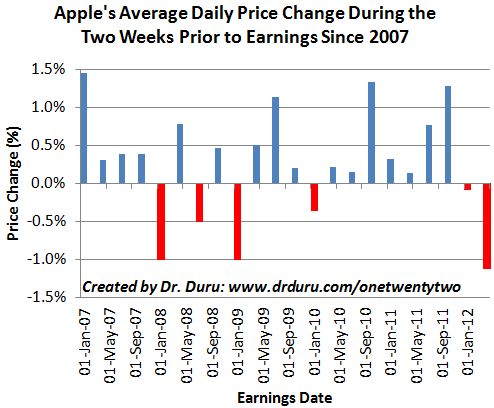

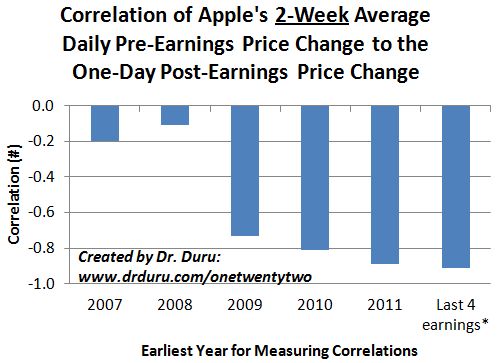

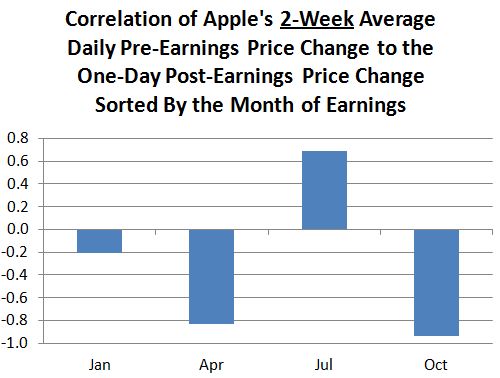

I went on to demonstrate the strong relationship between Apple’s average price change two weeks ahead of earnings, and the performance of the stock the day after earnings. This latest earnings report delivered in an astonishingly convincing fashion. Apple went into earnings with a -1.1% average price change over the prior two weeks of trading; it’s worst such performance since at least 2007.

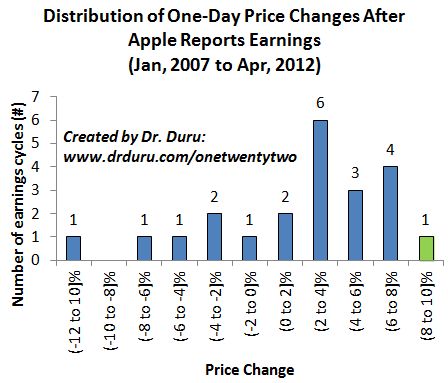

The stock closed the day after earnings with an 8.9% gain, its largest one-day, post-earnings gain since at least 2007.

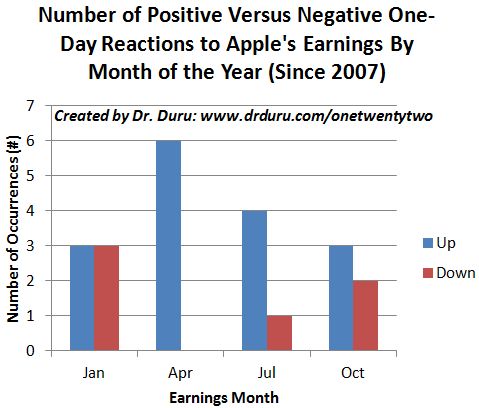

This performance further solidified the strong tendency for Apple to experience positive gains after earnings, including a perfect performance for April.

Apple’s post-earnings performance is now even more strongly, negatively correlated with its 2-week average price performance over the last three years. The negative correlation is almost as perfect as one could expect!

{snip} This relationship provides yet more icing on top for the case of a strong April post-earnings performance following an exceptionally weak two weeks of trading.

{snip}

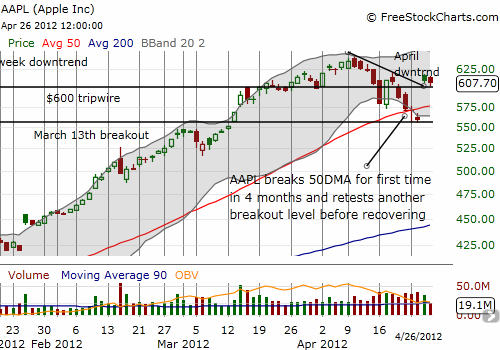

Given that Apple did not provide any sizzle to its guidance for the current quarter, I suspect Apple will meander for a while. {snip}

{snip}

Until the next earnings report, be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 27, 2012. Click here to read the entire piece.)

Full disclosure: no positions