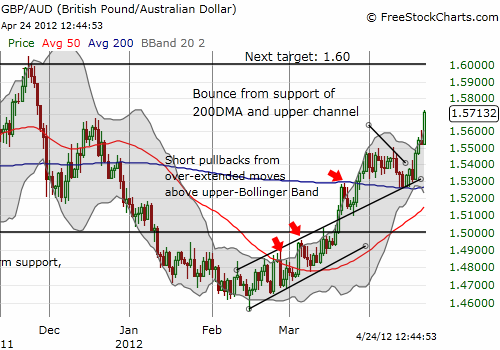

Last week, I pointed out how the currency pair of the British pound versus the Australian dollar (GBP/AUD) was setting up for a breakout. That breakout occurred two days later and continues at the time of writing following weak consumer price index data from Australia. I sold my latest round of GBP/AUD long as I now anticipate a pullback. I point out in the chart below how each time GBP/AUD has stretched above the upper-Bollinger Band (BB), the curerncy pair has experienced a temporary pullback. I will reload once the next pullback begins.

The U.S. Federal Reserve’s next monetary policy statement on Wednesday could serve as the catalyst for a temporary pullback. I expect the Fed will re-emphasize its dovishness given how some have misinterpreted notes from the last meeting as communicating a hawkish tone. Such a statement should give a boost to the Australian dollar as it has served as a ready “risk on” currency.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: no positions