(This is an excerpt from an article I originally published on Seeking Alpha on March 26, 2012. Click here to read the entire piece.)

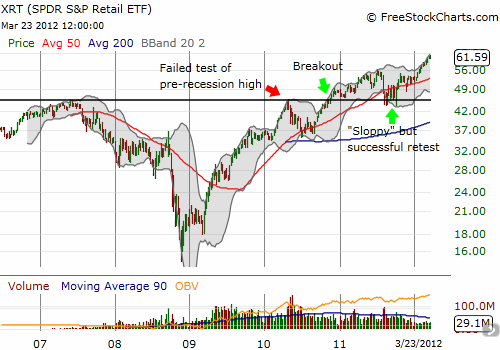

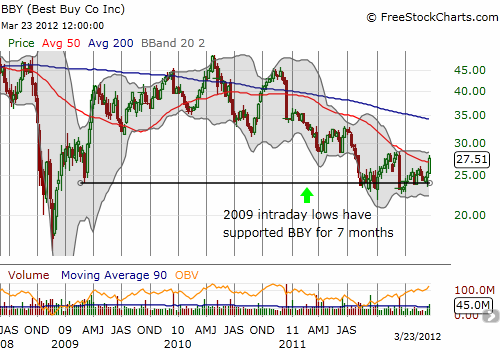

According to ETF Channel, Best Buy (BBY) is the second largest holding of the SPDR S&P Retail ETF (XRT). Yet, BBY is greatly underperforming this retail ETF. While XRT is at all-time highs and long-ago recovered all its post-recession losses, Best Buy continues to cling to tenuous support from its 2009 intra-day lows.

Source: FreeStockCharts.com

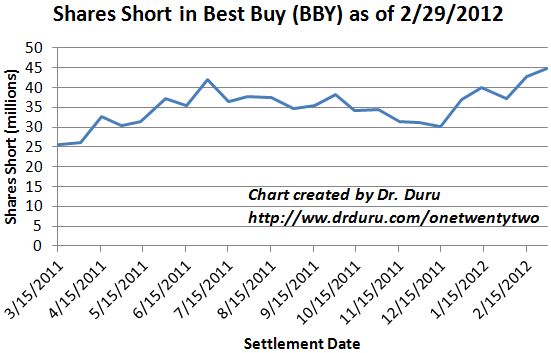

{snip} After reviewing BBY’s prospects three main things stuck out to me. First, shares short are at their highest level in at least a year, increasing about 50% in just three months:

Source: NASDAQ.com short interest

Second, options players have fought the recent price gains by piling into puts. {snip}

In other words, BBY has tremendous upside if and when it turns sales momentum upward and turns market sentiment around. At a low 7.4 forward P/E, a 0.19 price-to-sales ratio, and a 2.3% dividend yield (compare to 12.1, 0.55, and 2.1% respectively for Target), Best Buy is priced for low expectations.

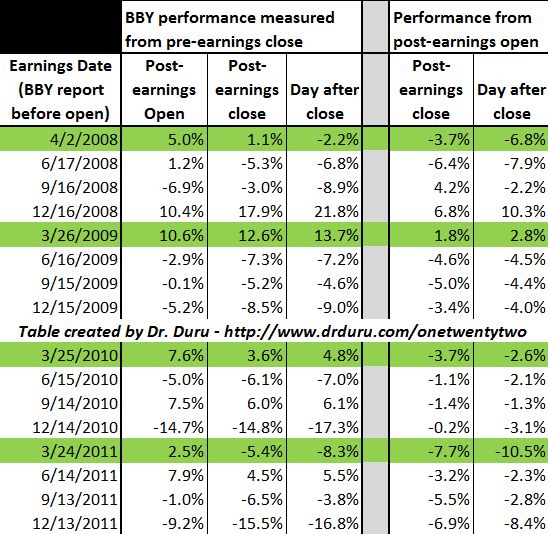

This leads me to the third thing that caught my interest about Best Buy. Since 2008, Best Buy’s first earnings report after Christmas has always produced a positive open. However, traders have also almost always faded BBY’s earnings after the open.

Here is a table displaying Best Buy’s performance after reporting earnings for the last four years:

Sources: Price data from Yahoo!Finance, Earnings dates from briefing.com

{snip}

This fascinating history suggests that traders can wait until Best Buy’s performance is known at the post-earnings open before initiating a position. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 26, 2012. Click here to read the entire piece.)

Full disclosure: no positions