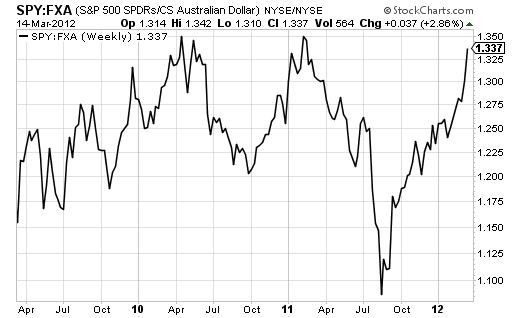

Someone forgot to tell the Australian dollar that financial markets are in “risk on” mode. While the Australian dollar is still up for the year against the U.S. dollar, it continues to lag the S&P 500 (SPY) by a greater and greater distance. The Aussie is now up 2.6% versus the U.S. dollar whereas the S&P 500 is up 10.9% year-to-date. When I wrote last week that “My Love Affair with the Australian Dollar Has Finally Ended,” I lamented that the specter of currency intervention added one too many risks to holding FXA, the Rydex CurrencyShares Australian Dollar Trust. The expanding under-performance pretty much seals the deal for me.

Source: Stockcharts.com

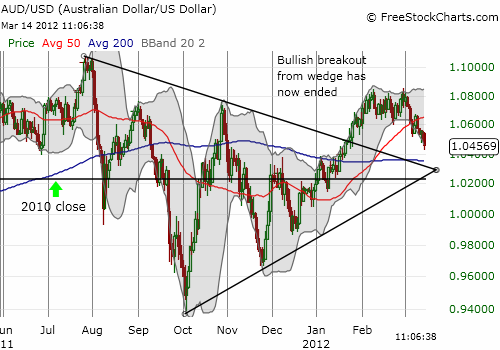

The chart below suggests that the Australian dollar has topped out for a while. A month of churn in February has given way to a steady decline that now threatens January’s bullish breakout. The wedge (or triangle) I drew is a bit stylized, but it demonstrates clearly that the Aussie dollar is still clinging to a bullish mood. The next big test will come at the uptrend line which will happen to coincide roughly with 2010’s close.

Source: FreeStockCharts.com

I still find the Aussie very useful in short-term forex trades. I am slowly rebuilding positions against a basket of currencies in anticipation of some kind of bounce, perhaps to the 50-day moving average now hovering overhead.

Stay tuned and be careful out there!

Full disclosure: long AUD/USD, short GBP/AUD