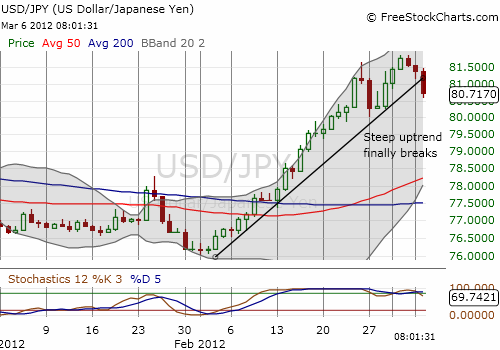

Almost two weeks ago, I underlined the case for on-going weakness in the Japanese yen. The U.S. dollar had rallied to 80.60 against the yen (USD/JPY) in almost a straight line. I chose that point to close out my yen shorts to wait for what I thought would be an inevitable pullback from such a sharp move.

It took today’s correction in worldwide stock markets to finally rekindle strong interest in the yen again. Although USD/JPY has yet to break below 80.60, I decided to start rebuilding shorts against the yen. I strongly suspect the yen will eventually press currency pairs to supports at the 50 and/or 200-day moving averages, but I want to have at least small positions in place in case the yen’s weakness once again outstrips my expectations.

The trend break is clear in the chart of USD/JPY below. This follows a marginally new 9-month high which itself was preceded by another large down day. These large one-day moves suggest the upward momentum in USD/JPY is finally exhausted for now. It is time for some consolidation and/or a firm test of lower support at the 50 and/or 200DMAs below.

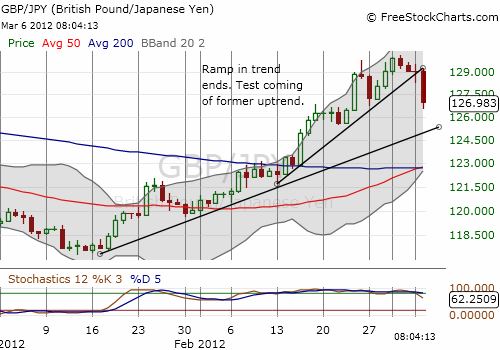

Against the pound, the yen has only broken the strongest uptrend in place which represented a ramp up in GBP/JPY. For the same reasons that apply to USD/JPY, I think GBP/JPY is showing it is ready for a rest and/or test of critical lower support. In this case, there is still one more uptrend that can provide support.

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long USD/JPY