(This is an excerpt from an article I originally published on Seeking Alpha on February 13, 2012. Click here to read the entire piece.)

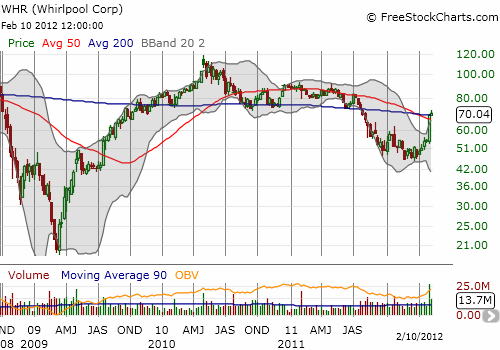

Whirlpool (WHR) has gained 29% since reporting fourth quarter and full-year earnings on the morning of February 1. At the time, WHR represented an explosive combination of a business turning around its fortunes through pricing power and productivity gains, a cheap valuation, an imminent bottom in housing for 2013, relatively high dividend yield, and a large short interest. {snip}

Source: FreeStockCharts.com

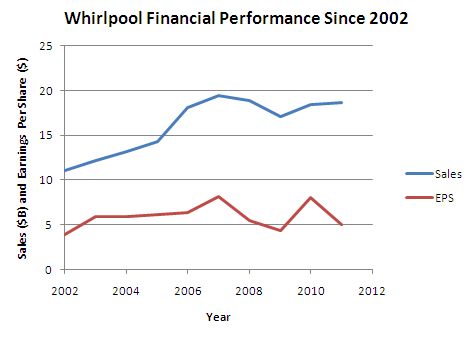

2011 was a poor year for Whirlpool both in its stock price and business performance. The stock lost 47% as revenues flattened and earnings plunged versus 2010 levels.

Source: MSN Money historical financial statements for WHR

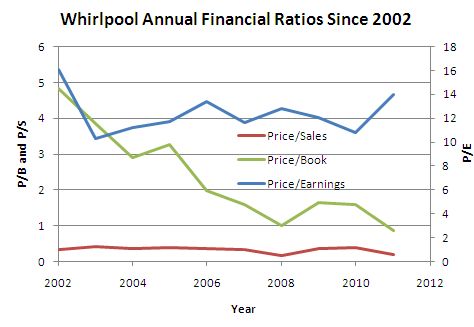

{snip} In the meantime, I think the stock has delivered the bulk of its upside for 2012 (already 48%!) absent additional positive catalysts. I base this assessment on WHR’s historical valuation metrics and 2012 guidance. Over the past 10 years, WHR’s current trailing P/E of 14 is second only to 16.1 in 2002. {snip}

Source: MSN Money historical financial ratios for WHR

{snip}

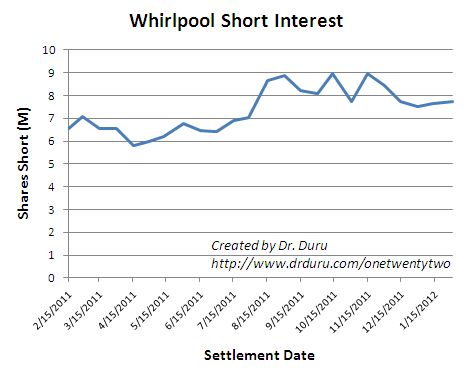

The abrupt repricing and re-appreciation of Whirlpool has probably been aided by some short covering. Shorts are currently 12.3% of WHR’s float. The chart below shows that short interest had begun to slowly creep upward after dropping from 2011’s highs in December.

Source: NASDAQ.com

{snip}

Supporting the optimistic scenario for WHR is the story management told of the company’s ability to match material cost pressures with productivity gains. Pricing power in Europe and particularly in North America is allowing the company to expand margins. {snip}…

{snip}…

…{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 13, 2012. Click here to read the entire piece.)

Full disclosure: long WHR shares, calls, and puts.