(This is an excerpt from an article I originally published on Seeking Alpha on January 17, 2012. Click here to read the entire piece.)

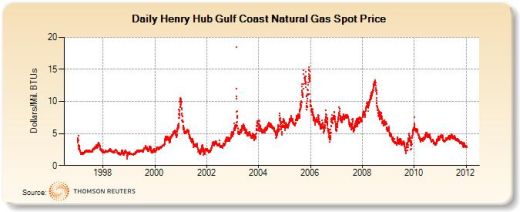

Last year I wrote a two-part series leveraging the work of Jeremy Grantham to develop a strategy for profiting from a crash in commodity prices (see “Profiting from Physical Assets in a Resource-Constrained World – Rules and Picks“). Since then, commodity-related stocks have dipped several times and in many cases triggered buying opportunities by erasing their QE2-inspired gains. Yet, no crash has occurred, and I am increasingly thinking no crash is imminent. However, there is one commodity that seems to have crossed the crash threshold: natural gas.

{snip}

Source: U.S. Energy Information Administration

Given my desire to buy into commodities on the cheap, it certainly seems time to expand my exposure in natural gas. I consulted with a friend of mine…{snip}

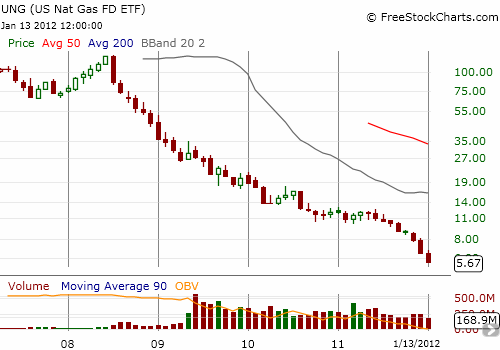

…the wait until the next spike is killing anyone trying to hang on through UNG:

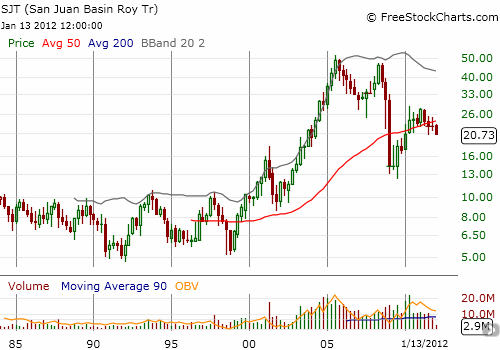

I previously listed San Juan Basin Royalty Trust Co (SJT) and Guggenheim Canadian Energy Inc (ENY) as preferable plays on natural gas…{snip}

ENY is a fund that tracks the market-timing Sustainable Canadian Energy Income Index. {snip}

Source for charts: FreeStockCharts.com

In the meantime, I am holding onto SJT although it has dropped 11% from where I bought it last year. I will be adding to the position on any steeper sell-off, and then will purchase ENY at what I will consider to be a very attractive entry point.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 17, 2012. Click here to read the entire piece.)

Full disclosure: long SJT