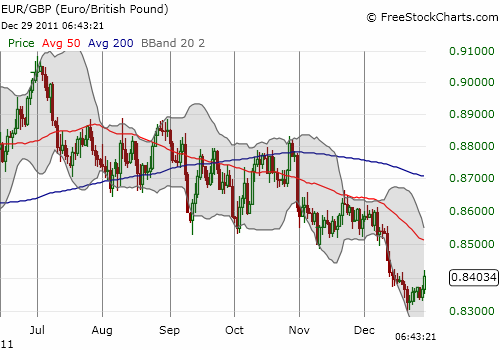

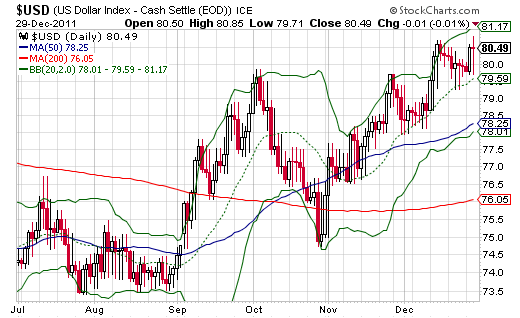

Recently, the euro has received more focus than ever, especially as it printed new 11-month lows against the U.S. dollar and new 11-YEAR lows against the yen today (December 29th). However, over the past week, the British pound has fared even WORSE than the euro. The euro is now trading at 10-day highs versus the pound.

Source: FreeStockCharts.com

Granted, this bounce has occurred after the euro printed 11-month lows against the pound and a definitive downtrend remains, but my point is that something may have changed. That is, either a catalyst has arrived to support ever higher levels for the U.S. dollar and even the Japanese yen OR the euro is in the midst of a slow (and subtle) bottoming process. I will be keeping a close eye on these possibilities in the coming days and weeks.

I remain as bearish as ever on the British pound, but I fully acknowledge the possibilities for a sharp short squeeze in the euro…which I will be all too happy to fade if it arrives.

Source: Stockcharts.com

Be careful out there!

Full disclosure: net short the euro and the pound, net long the U.S. dollar, net short the Japanese yen (I have significantly reduced ALL currency positions over the past week in order to lock in profits).