This is an excerpt from an article I originally published on Seeking Alpha on December 15, 2011. Click here to read the entire piece.)

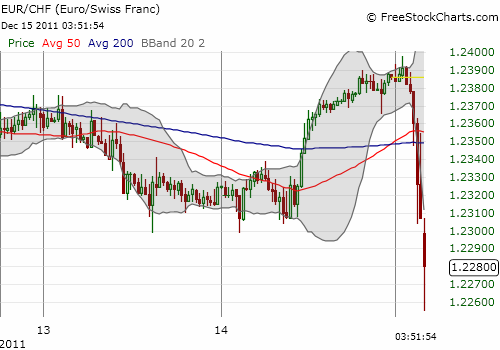

In its latest monetary policy assessment, the Swiss National Bank (SNB) “reaffirmed its commitment to the minimum exchange rate of CHF 1.20 per euro.” The SNB also gave its sternest warning yet about the risks of deflation by concluding “in the foreseeable future, there is no risk of inflation in Switzerland.” The SNB revised its inflation forecasts downward from the previous quarter as the sharp appreciation in the currency has hurt economic growth. Real GDP is expected to grow only 0.5% next year. Inflation this year will likely hit a paltry 0.2%. Next year, the SNB forecasts that prices will DROP, generating an inflation rate of -0.3%. In 2013, prices will barely recover with a 0.4% inflation rate.

The SNB followed the lead of other central banks over the past several months in warning about the economic risks coming from the sovereign debt crisis in Europe:

…{snip}…

Source: FreeStockCharts.com

However, the SNB appears as firm as ever in its desire to weaken the currency: …{snip}…

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on December 15, 2011. Click here to read the entire piece.)

Full disclosure: net short the Swiss franc