This is an excerpt from an article I originally published on Seeking Alpha on December 5, 2011. Click here to read the entire piece.)

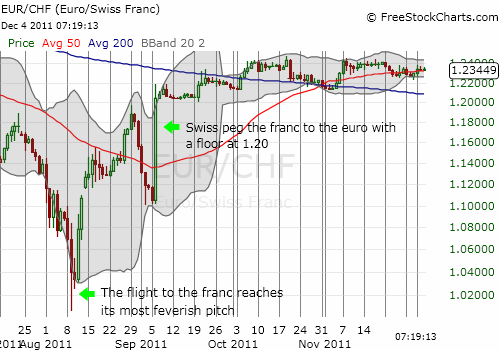

The Swiss are getting impatient with their stubbornly strong currency. Ever since establishing a peg to the euro and a floor at 1.20 for EUR/CHF two months ago, the euro has not gained much more over the Swiss franc.

Source: FreeStockCharts.com

The latest proposed remedy is to tax offshore deposits and perhaps even return to negative interest rates. The Guardian notes that “negative deposit rates were imposed as the Swiss battled a red-hot currency in the 1970s, but they did little to weaken the franc.” {snip}

I never cease to marvel at the difficulty some countries have in devaluing their currencies. Ben Bernanke once noted that it must always be possible to devalue a currency, otherwise a central bank could print enough paper to buy up all the assets of a given country (or countries even). In other words, eventually the market has to “wise up” and destroy a currency that is getting printed in such quantities. {snip}…

So, how to trade this setup?

The on-going and looming downside potential in the euro means that playing franc devaluation with EUR/CHF presents notable downside risks. Instead, going short the franc against other currencies may present a more palatable strategy.

{snip}

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on December 5, 2011. Click here to read the entire piece.)

Full disclosure: short EUR/CHF, long USD/CHF (planning to soon go long AUD/CHF and GBP/CHF again), planning to sell position in FXF