This is an excerpt from an article I originally published on Seeking Alpha on October 30, 2011. Click here to read the entire piece.)

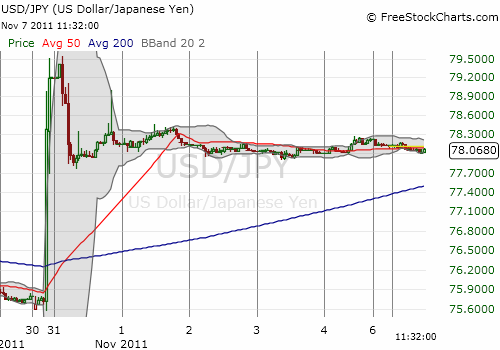

Call it a minor victory for Japanese Finance Minister Jun Azumi who declared his country is in “a war of nerves” with markets over the value of its currency given the yen “…has not reflected economic fundamentals.” After a massive currency intervention to weaken the yen that reportedly cost a record $100B to execute, the yen has held steady against the U.S. dollar for a little over a week – even through another Federal Reserve meeting and another week U.S. employment report.

There appears to be a stalemate between those who see this intervention as an opportunity to buy yen at cheaper levels and those that are starting to believe that the Japanese may finally succeed in creating some kind of cap for the yen. The commentary reported in various media last week are quite telling (see “Doubts Cloud Tokyo’s Yen Intervention” in the WSJ and “Japan Keeps Market Edgy After $100 Billion Intervention” in Reuters):

{snip}

I am in the “this time is different” camp… {snip}

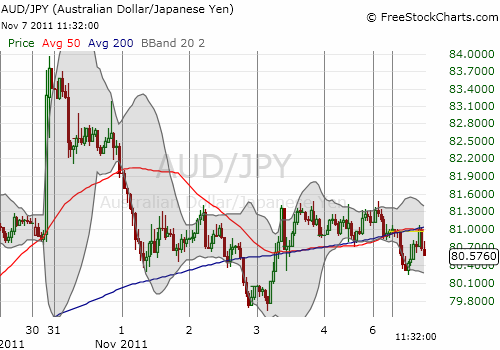

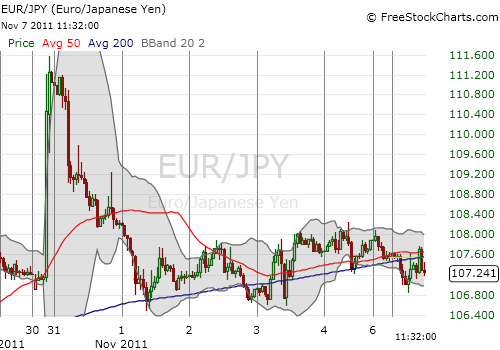

I closed out bearish yen positions into the immediate aftermath of the intervention. As the impact wore off during the week against other currencies, I rebuilt bearish yen positions. I am using AUD/JPY to play the current trading range until it breaks out or down. I am hedged a bit with a short GBP/JPY position given I am still extremely bearish against the British pound.

Here are other hourly charts of other yen currency pairs since the intervention:

Source for all charts: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on October 30, 2011. Click here to read the entire piece.)

Full disclosure: net short yen