(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

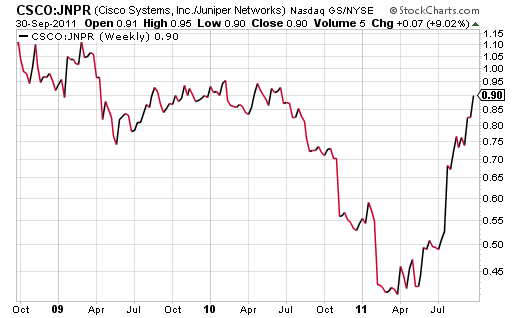

Two weeks ago, I described a potential pairs trade between Juniper Networks (JNPR) and Cisco Systems (CSCO) based on the ratio of their prices and relative valuations (see “Pairs Trade: Cisco Systems Is Catching Up To Juniper Networks“). I used the three-year history to suggest shorting JNPR to hedge a long position on CSCO until the price ratio hit 0.95. On Friday, JNPR dropped 6% for a total two-week loss of 14% and a 2 1/2 year low versus CSCO’s 7% loss over the same time period. The CSCO versus JNPR price ratio is now 0.90.

Source: stockcharts.com

{snip}

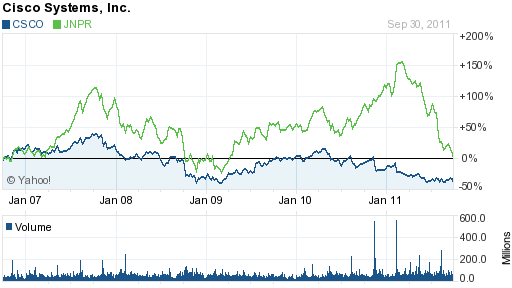

Source: Yahoo!Finance

{snip}…I recommend shorting CSCO shares (nearly zero chance of CSCO getting acquired before JNPR does) and buying JNPR calls expiring spring of 2012. Assuming CSCO has downside risk at least back to the 2011 (and 8-year) lows, I will size the position so that a 10% loss in CSCO pays for the JNPR calls. A more aggressive trader might overweight the JNPR calls. A more conservative trader might add an out-of-the money call on CSCO to cap potential losses on the CSCO short.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long CSCO