(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

The U.S. dollar confirmed yet again the importance of its 200-day moving average (DMA). I updated my review of this case two weeks ago by demonstrating in detail how the dollar sustains moves both above and below its 200DMA. {snip}…

Source: freestockcharts.com

Previously, I made the case that the fundamental support for a dollar rally is that alternative “safety” valves have become relatively very expensive. Everywhere the scared turn, they find serious drawbacks:

{snip}

With this backdrop, safety in the form of cash-money U.S. dollars looks extremely cheap with the dollar index hovering just above multi-decade lows…{snip}…The dollar was further helped by last week’s monetary policy statement from the Federal Reserve which did not include any new news of currency debasement. The Fed is just moving money from one investment (short-term bonds) to another (long-term bonds). Moreover, three board members objected to additional policy accommodation thus creating an unfamiliar (relatively) hawkish encampment in the Fed.

And then there is gold.

{snip}…enthusiasm for gold continues to wane.

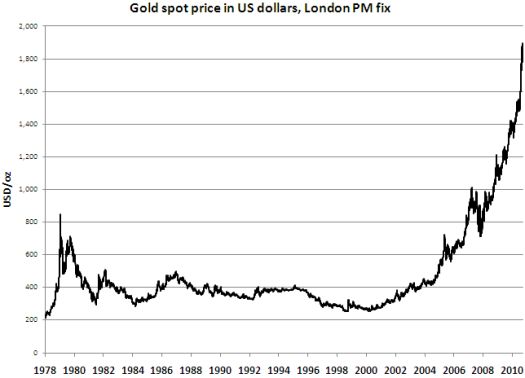

A long-term chart reminds us of both the source of the skepticism and the reality of gold’s enduring strength. {snip}

Source: World Gold Council – prices through Sep 16, 2011

A chart with a logarithmic scale gives better perspective. {snip} $1600 or so represents the first opportunity to buy gold. A move back to the primary trend line would occur around $1300 and that level would deliver the second good buying opportunity. Gold closed Friday at $1640.

Source: World Gold Council – prices through Sep 16, 2011

So what about silver? {snip}

Source: stockcharts.com

The buying opportunity is a little harder to gauge in silver, especially since it is more economically sensitive than gold. One potential gauge is the gold-to-silver ratio. {snip}

Source: stockcharts.com

In the meantime, I expect gold and silver to trade in volatile spurts both up and down. Fear is a funny beast. Those who bought gold and/or silver out of fear will be very confused since none of their fears have gone away…{snip}

For the calmer set eying trends and central banks, the buying opportunities are as clear as the continued desire and intent of financial authorities in the major economies to manipulate their currencies lower for economic advantage…{snip}

The only currency that cannot be printed at will and without limit is gold (and silver).

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long GLD, SLV, GG, PAAS; net long U.S. dollar, short the Japanese yen, net long the Swiss franc