(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Research In Motion (RIMM) will report earnings Friday, September 15. As usual, I will be most interested in finding out how aggressively RIMM has executed on its latest stock repurchase authorization that began in July.The unspent repurchase authority will help me estimate how much more life may remain in playing the buyback activity…{snip}

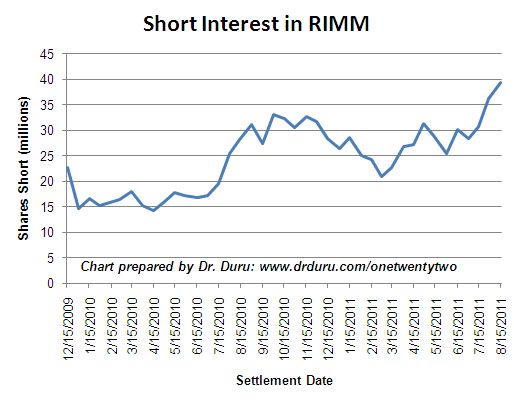

Unconvinced and unfazed, shorts have accumulated larger positions over much of this same time period. In fact, short interest soared to new multi-year highs in mid-August.

Source: NASDAQ.com

Ahead of RIMM’s June earnings call, I interpreted a decline in short interest in the prior month as potentially bullish for the stock. Not only was I wrong, but the next update on short interest showed that shares short turned upward directly ahead of the earnings report…{snip}

{snip}…Investment Underground reported last week in Seeking Alpha that Jeremy Grantham has purchased over one millions shares since the third quarter of 2010. I am sure the losses have hurt, but Grantham is known for his diligence and patience.

Those who have patiently held onto the September 30/35 call spread that I featured as a primary way to play RIMM’s buyback realized maximum value in the final days of August…{snip}…As the stock market clings to its momentum bouncing from the August lows, RIMM’s biggest headwind going into earnings may be the general market.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long RIMM shares, puts, and a call spread.