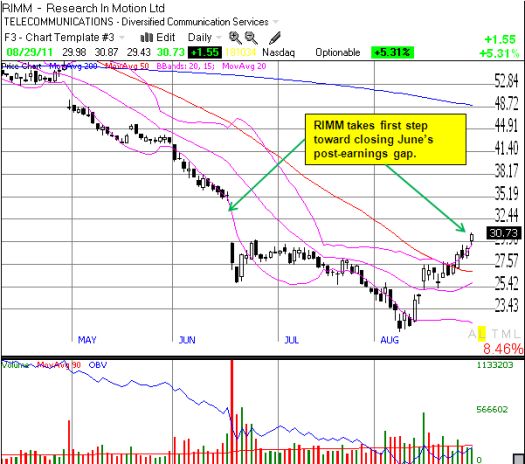

The trading playbook for Research In Motion’s share buyback is finally unfolding. Last week, Research In Motion (RIMM) broke out, nudging itself over the rapidly declining 50-day moving average (DMA). Today, RIMM finally closed above $30 and punched into June’s post-earnings gap down.

*Chart created using TeleChart

The September 30/35 call spread I recommended last month is now paying off for the patient. There remains plenty of time for this call spread to achieve its full potential, but it may depend on the strength of the stock market. The general stock market has finally exited oversold territory so the outlook for further gains for RIMM looks pretty good over the next few weeks. However, RIMM posts earnings on September 15, one day before the call spread expires. This event represents a major caveat to my bullish outlook given RIMM could drop another pre-earnings warning and/or disappoint again on the 15th.

When RIMM does report earnings, I will be eager to review how many shares the company repurchased since the authorization window opened last month. If past history is any indication, RIMM has aggressively purchased shares and will continue to do so. If August’s out-performance is any indication, RIMM’s purchasing support should continue to work for the duration of the buyback activity.

Be careful out there!

Full disclosure: long RIMM shares, calls, and puts