(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

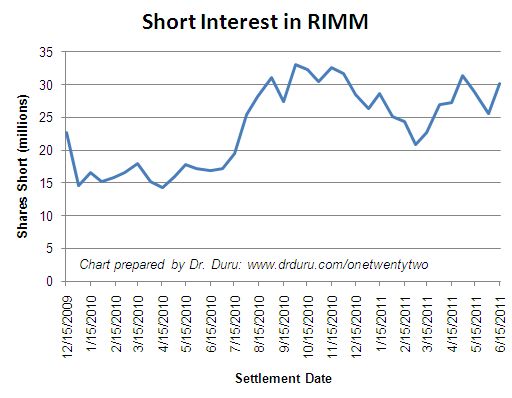

An apparent downward shift in short interest was part of my premise in speculating that Research in Motion (RIMM) could experience significant upside after its last earnings call. It turns out that shorts increased almost 25% in the two weeks leading into earnings, from 25.5M to 30.2M. Here is the updated chart:

Source: NASDAQ.com

So, rather than scrambling to get out of the way of RIMM’s earnings announcement, shorts were ramping up in eager anticipation. My mistake was in thinking that a 15% drop in short interest was a sufficient change to suggest a more bullish interpretation. This new data point now shows short interest is vacillating over a wide range just under recent highs rather and not shifting downward.

It also turns out that at least one trader made a very large bet against RIMM’s earnings…

{snip}

The next update on short interest should come right as the window finally opens for RIMM to begin repurchasing its shares again. Given the pressure on the stock and the rampant negativity on RIMM’s business prospects, I expect management to kick off buying right on July 10.

Be careful out there!

Full disclosure: long RIMM shares and puts