(This is an excerpt from an EXTENSIVE article I published on Seeking Alpha. Click here to read the entire piece.)

Just when you thought solar earnings could not disappoint the market any further…{snip}…LDK provided a pre-announcement that contained the news that the company canceled a debt offering because interest rates are higher than expected. This news demonstrates the bond market’s potential waning confidence, and I am guessing this translated quickly to lower confidence for equity holders…

{snip}

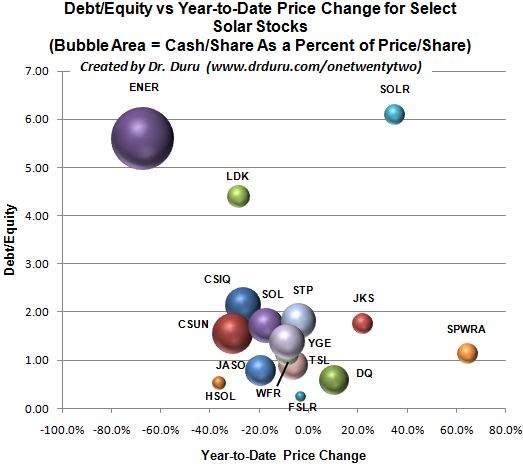

The chart below shows debt-to-equity ratios versus the year-to-date price changes for select solar stocks where bubble size represents the cash/share as a percentage of price/share (as of Friday, May 20, 2011).

{snip}

{snip}

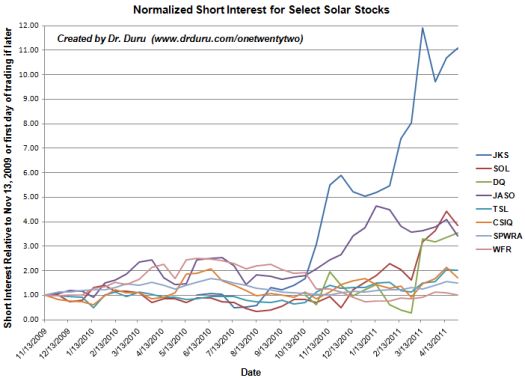

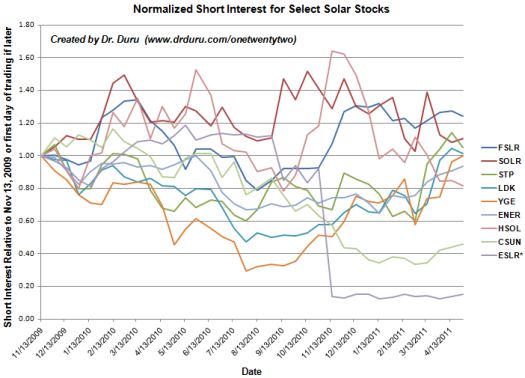

With the growing anticipation of over-capacity in the second half of this year, a bunch of disappointing results, and persistent selling in solar stocks that has accelerated recently as the stock market treads on precarious ground, shorts appear to be smelling blood in the water.

{snip}

You can be excused if you find yourself vehemently disagreeing with the shorts and thinking nothing is fundamentally wrong in the solar sector. First quarter results showed tremendous growth year-over-year in revenues and MW of shipments. Just about every reporting company is sticking by full-year guidance even if first quarter results came in under expectations or second quarter results are expected to be on the low side. All companies remain essentially full-steam ahead on aggressive capacity expansions.

{snip}

I am holding onto my current solar holdings and looking to add later in the year assuming the cycle-related selling has finally exhausted itself, perhaps by late summer or early fall.

{snip}

…I post some highlights from the earnings announcements and conference calls of several solar companies…

{snip}

Be careful out there!

(This is an excerpt from an EXTENSIVE article I published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long SOLR, FSLR, JKS, LDK, JASO, ESLR