Famous short-seller Dick Chanos visited the CNBC set on April 14 and talked about his expanding list of targets that includes alternative energy, especially First Solar (FSLR). In response, the stock dropped 2.7% that day and did not stabilize until the stock lost almost 10% over the course of a week. Directly ahead of another earnings announcement (May 3), I think it is worth visiting Chanos’s list of charges against FSLR.

See 5:30 to 6:35 for the commentary on First Solar and solar in general.

Chanos’s reasons to short solar stocks and First Solar in particular:

- Austerity in Germany, Italy, and Spain

- Solar cannot do baseload power – solar costs 3x coal and natural gas plants

- Enormous insider selling – the chairman has gotten rid of most of his stock in the last year and a half

- Lots of people are leaving (most of the executive suite)

Chanos says that the last two points create a pattern that short-sellers love.

At the risk of being the mouse squeaking at the lion, I will take some issue with Chanos’s thesis regarding First Solar:

- FSLR has laid out a long-term roadmap for reducing dependence on European demand and subsidized markets, first introduced in July, 2009. Moreover, in the last earnings call, FSLR indicated the company has the flexibility to sell 500MW in uncontracted volumes.

- FSLR is on a path to achieving grid parity in the next few years – 2014 in the Southwest USA. The current story on solar is not about completely replacing baseload coal and natural gas but instead becoming a bigger part of the mix as energy needs increase.

- Insider sales have indeed been large since at least 2009, and this is one of the tougher issues for FSLR bulls to address. The chairman and former CEO Michael Ahearn, sold a large quantity of stock near FSLR’s 2010 lows (in February) at the same time current CEO and another officer BOUGHT shares. CEO Robert J. Gillette purchased $1.05M worth of shares at the time. Ahearn and First Solar never explained this sale of 1.5M shares, but they were not a signal of FSLR’s imminent demise.

However, Ahearn launched an aggressive automatic sale program in March, 2011 that sold stock almost every trading day of that month for a total of 800K (including February 28). Ahearn got much better prices this time around, ranging from $140-155/share. No explanation has appeared for these sales. However, ultimately, I would consider sales by the current CEO to be a much bigger red flag. Until then, I consider him a major inside buyer who trumps other insider sales. Moreover, Ahearn is in a position where he has already become incredibly rich and, for all we know, he is gradually moving to protect his massive wealth. - The latest executive departure at First Solar was Bruce Sohn, President of Operations. Since Sohn was not replaced, this move looks like an organizational realignment that perhaps Sohn lost. I would be more worried if Sohn left, and FSLR was left scrambling for a replacement. Nevertheless, executive departures are only a net good if they occur to correct known problems. FSLR has not announced such a thing for any of the recent departures.

Moreover, at 13x forward earnings, I believe First Solar has never been cheaper, representing one of the better long-term values in these shares in a long time.

So, while I am not convinced by the case Chanos presents, I am also not pounding the table to buy FSLR ahead of earnings. We already know that most solar companies that have reported or guided this quarter have produced lackluster to disappointing results for their respective companies and/or the general solar market (see LDK Solar, Evergreen Solar, ReneSola and SunPower). We have to assume FSLR will do the same or similar. Based on earlier post-earnings reactions, we know it does not take much for sellers to descend upon FSLR in sight of the slightest blemish on FSLR’s results. I think such weakness will be another one of those ideal buying opportunities that I look for in solar stocks.

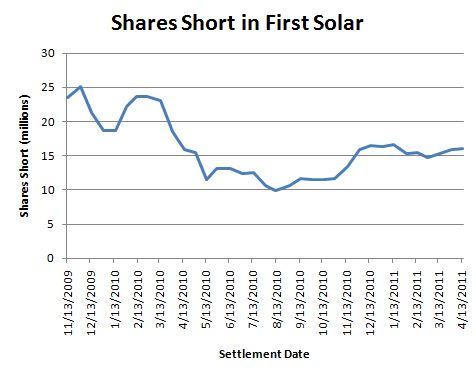

Dick Chanos has plenty of company although shares sold short has remained relatively steady for about five months after a quick ramp from 2010’s bottom in shares short. Today’s 16M shares short represents a whopping 33% of FSLR’s float.

Source: nasdaq.com

The chart below summarizes the current technical picture (snapshot from Monday morning). Note that in February FSLR exceeded my upside valuation range of $162, getting as high as $175 partially on the boost of a Goldman Sachs upgrade. My downside floor remains $105 with an anticipated trading range of $120-150.

*Chart created using TeleChart:

Be careful out there!

Full disclosure: long FSLR, ESLR, and LDK