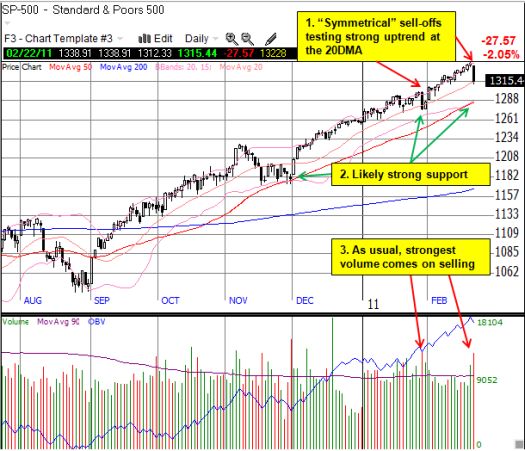

For one day at least, sellers converged with stock market technicals to deliver a large one-day drop in the S&P 500.

As it turned out, the three-month highs in T2108, the percentage of stocks trading above their 40-day moving averages (DMAs), did matter after all. T2108 plunged along with the stock market for its worst one-day performance since mid-November. T2108 is no longer overbought at a much cooler 60%. I failed to maximize the opportune purchases of the SSO puts from Friday: the relentless buyers in the market have trained me to expect rapid absorption of dips, and I wasted no time locking down profits soon after the market open. The buyers did make their usual appearance soon after the open, but their bargain hunting came to a rare end within an hour. By the close, Tuesday became that extremely rare day in 2011 where the stock market actually closed near its lows (and even made fresh intraday lows in the process).

One of the many interesting features of the day was the dollar’s inability to maintain its strength as a “safe haven.” By the end of the U.S. trading session, the dollar essentially gave up most of its gains. The first killjoy was the euro which lifted upward with news that the ECB may be leaning toward hawkish language (and action?) against growing inflationary pressures. Next, it was the yen taking its turn beating up on the U.S. dollar. Bringing up the rear was a slow and steady recovery in the pound. The Swiss franc ended the day the clear winner as its strength rarely wavered against any of the major currencies. The end result was a telling fade for the greenback.

The dollar held its own for all of one day when fear struck the markets over the chaos in Egypt. With the onset of the Libyan crisis, the dollar could barely hold flat for the day. The underlying weakness is quite telling and one more sign that long-term support for the dollar is not likely to last much longer.

Now, having said that, I also recognize that the dollar is not likely to break through long-term support in a straight path. Accordingly, I switched to a small net long position in the dollar…to be set free at the next opportunity.

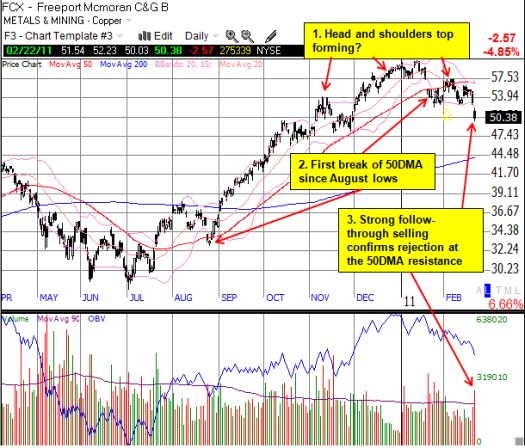

The dollar fared best on the day against the commodity currencies, the Canadian and Australian dollars. So, I took particular interest in follow-through on a technical breakdown in Freeport Mcmoran C&G (FCX), one of the more popular plays on copper on the market.

*All charts created using TeleChart:

So while the S&P 500 has been moving nearly straight up for the first seven weeks of the year, FCX has given up all its gains from December and is now down 17% for 2011. I am not ready to predict it will retest the 200DMA resting patiently below, but FCX will be one of many important stocks to watch to gauge the health of the underlying bullishness of the market.

Be careful out there!

Full disclosure: net long the U.S. dollar