Currency traders appeared very disappointed that the Bank of Canada left interest rates unchanged on Tuesday. The Canadian dollar (“loonie”) immediately bounced sharply from near three-year highs against the U.S. dollar, and the USD/CAD eventually popped over parity (1.0) for the first time in two weeks on Thursday.

The accompanying statement suggested that the Bank of Canada is quite reluctant to raise rates again anytime soon. For example, Canada’s strong currency and lagging productivity are exerting drags on the economy:

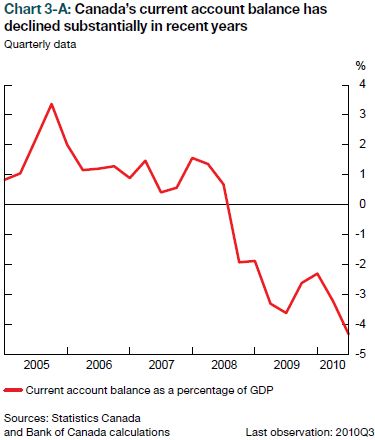

“…the cumulative effects of the persistent strength in the Canadian dollar and Canada’s poor relative productivity performance are restraining this recovery in net exports and contributing to a widening of Canada’s current account deficit to a 20-year high…”

The statement concluded that current rates leave “…considerable monetary stimulus in place, consistent with achieving the 2 per cent inflation target in an environment of significant excess supply in Canada. Any further reduction in monetary policy stimulus would need to be carefully considered.” (emphasis mine)

In other words, the Canadian economy will have to turn in a much stronger performance before the Bank of Canada will allow rates to increase much, if at all, from current levels anytime soon. I find this conclusion an interesting and awkward companion for Governor Mark Carney’s warning to Canadian consumers that they should not plan on enjoying these low, accomodative rates over the long-term.

The Bank of Canada’s “Monetary Policy Report“, released the following day, clarified for me why the Bank of Canada remains cautiously optimistic about economic prospects. Based on the Bank’s assessments I am estimating that the Canadian dollar is unlikely to get much stronger against the U.S. dollar from here. I am expecting USD/CAD to bounce around parity providing a sustained trading range that currency bears and bulls can enjoy. The chart below shows the historic nature of the Canadian dollar hitting parity with the U.S. dollar – it is not a difficult stretch to estimate that USD/CAD will not sink much further from here.

Source: dailyfx.com charts

This was my first time reading through the Monetary Policy Report, and I found it very valuable and educational. Here are some of my thoughts and reflections on this report divided into themes.

There are three key reasons why the currency is not likely to gain much more over the U.S. dollar – assuming the Bank of Canada’s base case materializes. (Indeed, the Bank’s base case for its economic assessments includes an average US/Canada exchange rate of 100 cents U.S.)

- Canada’s economic growth for the next two years will slightly underperform economic performance in the U.S. The Bank projects Canadian GDP growth of 2.4% in 2011 and 2.8% in 2012. Meanwhile, the U.S. should grow 3.3% in 2011 and 3.2% in 2012.

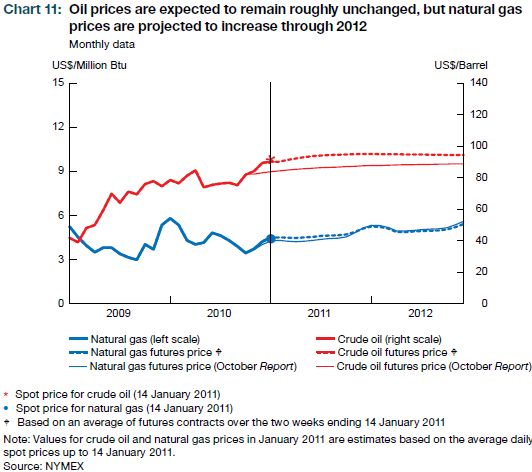

- Oil prices have peaked for the next two years. Oil is a key commodity for Canada and a major export to the U.S.

- As implied above, further strength in the currency will hurt Canada’s economic performance.

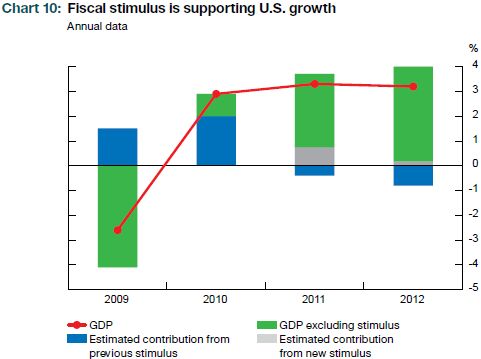

The Bank of Canada included some assessments of the impact of fiscal and monetary stimulus on economic growth. The Bank sees U.S. stimulus having a significant impact on growth with some residual positive impact for Canada:

“…a new round of U.S. fiscal stimulus was passed into law on 17 December…The package is expected to support U.S. consumer spending and to contribute significantly to U.S. GDP growth in the near-term. The Bank estimates that the total effect will boost U.S. GDP growth by 0.8 percentage points in 2011 and 0.2 percentage points in 2012 overall, the monetary and fiscal policy packages should contribute 1.0 percentage points to U.S. GDP growth in 2011 and 0.3 percentage points in 2012.”

Moreover,

“All else being equal, the Bank estimates that the two stimulus packages [including the Federal Reserve’s quantitative easing] should add about 0.2 percentage points to Canada’s GDP growth in 2011 and 0.1 percentage points in 2012.”

The Bank even posted a chart showing the significant positive impacts from all of the U.S.’s efforts to stimulate economic growth. This further confirms that Carney thinks of stimulus as an effective tool for dealing with economic malaise.

Source: Bank of Canada Monetary Policy Report, January, 2011, page 12

The Bank generated its expectations for oil prices based on futures curves projecting a $95/barrel price in 2012. This assumption means oil will essentially remain flat for the next two years or so.

Source: Bank of Canada Monetary Policy Report, January, 2011, page 13

The Bank is clearly worried about the competitiveness of its labor force, especially relative to the U.S.:

“Since the beginning of 2005, the sizable appreciation of the Canadian dollar explains about two-thirds of the increase in unit labour costs in

Canada vis-à-vis the united States wage growth in the two countries has been broadly similar over the period, leaving Canada’s productivity underperformance to account for the remaining deterioration in this measure of competitiveness: labour productivity in Canada has grown at an average annual rate of just 0.5 per cent since the first quarter of 2005, compared with 2.1 per cent in the United States…”“…The decline in Canadian exporters’ share of the U.S. market, by far

Canada’s largest export market, is evident across a wide range of goods, including machinery and equipment, consumer goods, and non-energy commodities.”

The resulting decline in Canada’s current account balance has been quite dramatic:

Source: Bank of Canada Monetary Policy Report, January, 2011, page 17

Combine these reasons with a tame outlook for inflation, and we get a Canadian central bank that will find it difficult to justify significant increases in rates in the near-term. The volatility in the USD/CAD currency pair will thus not likely lead the exchange rate too far astray from parity. If anything, the dollar may have a slight advantage over this time period under this base scenario.

Be careful out there!

Full disclosure: long USD/CAD