We finally got the news on INTC that the market appears to have long anticipated. This morning, Intel (INTC) lowered revenue and margin guidance. Revenue guidance is now “…$11.0 billion, plus or minus $200 million, compared to the previous expectation of between $11.2 and $12.0 billion.” Margin guidance is “…now 66 percent, plus or minus a point, lower than the previous expectation of 67 percent, plus or minus a couple of points.”

INTC explains the market is weaker than expected:

“Revenue is being affected by weaker than expected demand for consumer PCs in mature markets. Inventories across the supply chain appear to be in-line with the company’s revised expectations.”

However, enterprise demand is still supporting stronger performance:

“The impact of lower volume is being partially offset by slightly higher average selling prices stemming from solid enterprise demand.”

The stock was halted before the news and sold off a little after re-opening. At the time of writing, buyers have already stepped in to send the stock firmly into positive territory (shorts covering on the news?). With the stock at 52-week lows, I am sure some will be tempted to assume this news represents the worst of the bugs hiding under the rocks, giving the all-clear for some kind of relief rally. The line about strong enterprise demand and the “small” size of the downward revision will serve as rungs of hope to justify buying into the bad news.

I consider this the first true acknowledgment of my on-going working assumption that INTC has hit peak performance.

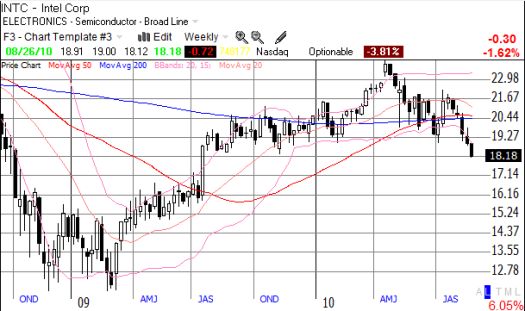

The weekly chart below shows the persistence of the downtrend since the April highs. Also note how INTC is now working on erasing its impressive 17% one-week gain in the wake of earnings from July, 2009.

*All charts created using TeleChart:

Be careful out there!

Full disclosure: no positions