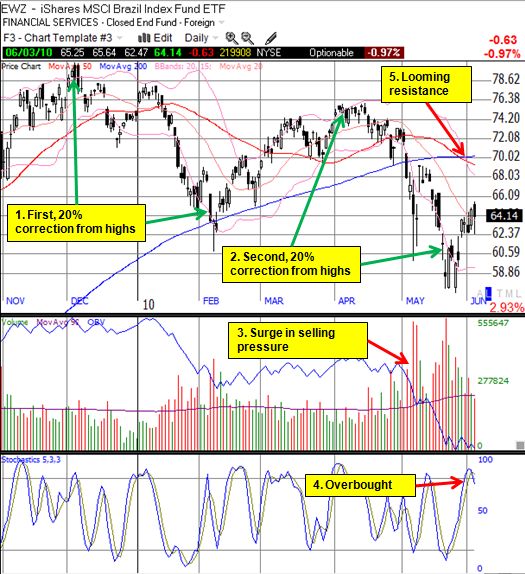

I spent a lot of time over the past oversold period studying rules and guidelines for trading the (inevitable) bounce out of the selling pressure. The oversold period ended inconclusively, but my rule for buying the ETF for Brazil, iShares MSCI Brazil Index Fund ETF (EWZ), definitively worked for a second time. When EWZ started to break down after the Brazilian government announced a “stock tax” in October, I recommended waiting for a 20% correction before buying EWZ. That correction did not arrive until four months later, but it led to a healthy bounce in the shares.

This last sell-off provided yet another opportunity, and I flagged the 20% correction rule in late May. (I received slightly better pricing given I noticed the trigger a day late). At the time I cautioned that a downtrend seems underway in EWZ, and I see no reason to believe that EWZ will overcome looming overhead resistance in the near-term to break the on-going downtrend. With technicals reaching overbought conditions, I closed out the EWZ play on Thursday well below the 50 and 200DMAs.

I remain “cautiously bullish” on the Brazilian story, so I will continue to look for buyable dips. The worsening technicals suggest that shorting the rallies has become a viable strategy for the bears.

The chart below shows the current technical set-up.

*Chart created using TeleChart:

Be careful out there!

Full disclosure: no positions