The news has rippled across the globe that the U.S. Securities Exchange Commission (SEC) finally got around to charging Goldman Sachs with fraud:

“The SEC alleges that Goldman Sachs structured and marketed a synthetic collateralized debt obligation (CDO) that hinged on the performance of subprime residential mortgage-backed securities (RMBS). Goldman Sachs failed to disclose to investors vital information about the CDO, in particular the role that a major hedge fund played in the portfolio selection process and the fact that the hedge fund had taken a short position against the CDO.”

Stories have long circulated about how Goldman allegedly cleaned up in the aftermath of the housing bubble. The New York Times wrote an expose in December, 2009 called “Banks Bundled Bad Debt, Bet Against It and Won” that provided extensive detail about how financial firms like GS and Deutsche Bank (DB) made money betting against the CDOs they created for investing in the overheated market for mortgages. In that article, the NYT indicated that the SEC was investigating the situation. So, Friday’s announcement of fraud charges only comes as a surprise because so many of us have grown so accustomed to the SEC’s tolerance for a certain level of questionable behavior on Wall Street.

(Harry Markopolos wrote an excellent book, “No One Would Listen: A True Financial Thriller,” on how the SEC ignored his five warnings over several years about Bernie Madoff’s Ponzi scheme. I hope to write a review of it soon. The SEC insists it is changing for the better under the new leadership of Chairwoman Mary Schapiro. The latest protestations came in response to the Inspector General’s official revelation that the SEC knew about the Stanford Ponzi scheme as early as 1997 – timed for release after the GS fraud charges!)

So, as the SEC attempts to make up for lost time in enforcing securities laws and protecting investors, we should see numerous “big name” and “big splash” charges as the fallout from the financial panic rolls on. Friday’s timing was interesting for the political implications with financial reform stalling in the Senate, but it was even MORE remarkable that the SEC chose options expiration to make its announcement. Surely, the SEC knows that such dramatic news will have maximum impact on a day in which even small moves in stocks can generate huge gains (and losses) in the options pits. The steep selling in GS, and financial stocks generally, was likely exaggerated by the mechanics of options expiration. All the better to spread a little fear and punctuate the SEC’s announcement.

The damage to Goldman’s stock is very clear on the daily chart. After optimistically popping along with JPMorgan’s earnings results, GS has now broken below support which now becomes resistance. Although volume was at wash-out levels, GS remains a short until it manages to overcome the new resistance. New lows for 2010 will further confirm the bearish technicals.

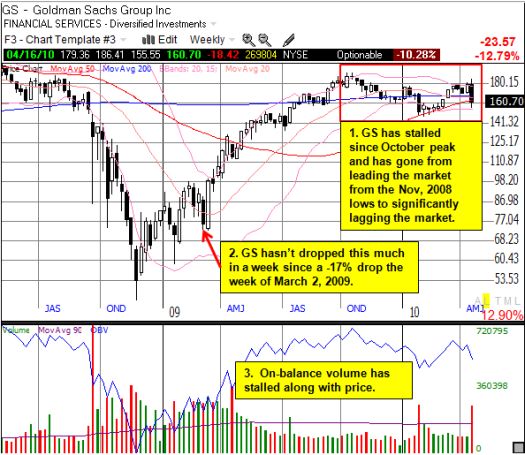

GS led the stock market out of the bear market by making a higher low during the March, 2009 bottom in the stock market. However, GS peaked in October and has lagged the stock market ever since (I first noted the ominous turn in November). The weekly chart below summarizes the long-term perspective on the stock:

I think before the year ends, or at least upon conclusion of the SEC’s case, GS will regain the highs for this year if not 2009. However, I expect in the shorter-term, GS should experience more declines – at least a retest of the 2010 lows – as the fears of the SEC should linger, if not grow, and speculation grows about the impact to Goldman’s business and reputation (if all the stories in the past several years have not already soiled Goldman’s reputation, I do not think an SEC charge or conviction will!). The trade here is tricky given since GS could just as easily rebound starting Monday as sell-off for weeks to come. In between there, GS could just as easily churn like dead money waiting for resolution of the SEC case. So, I have started to scale into a small long position alongside a July put spread. An eventual move to some extreme, up and/or down, will be the best outcome overall for this positioning. I will manage and adjust it as needed.

Finally, here is a daily chart of Deutsche Bank AG (DB). The market now fears the SEC will be going after DB next. (Sometimes it is better to be lucky than smart as I just happened to have a large trading position short DB going into today that I built up during this week. I was skeptical of the optimism form the latest Greek bailout news, and then doubly skeptical of the sympathetic rally on JPMorgan’s earnings results. I closed out the position “too early” at $77).

*All charts created using TeleChart:

Be careful out there!

Full disclosure: short GS with put spread, long GS shares