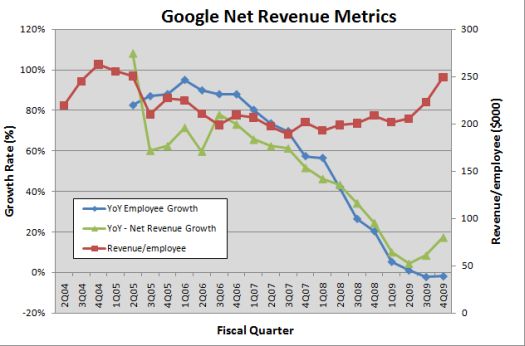

In my last piece on Google (GOOG), I neglected to post an update to my chart on the company’s revenue metrics using the 2009 fourth quarter earnings report. The chart below shows that revenue per employee has now returned to the highs at the beginning of GOOG’s existence as a public company.

Assuming that net hiring will remain relatively flat for some time to come and that year-over-year revenue gains are now on a sustained upswing, I expect further gains in revenue efficiency. This makes GOOG an even more attractive stock for 2010 although the weaker trading environment along with the current news overhang with Nexus One, Apple, China, insider stock sales, etc… are likely to continue to weigh on the stock. Indeed, trading volume remains heavy in GOOG and most of that to the downside (see chart below). Once these issues work their way through “the system”, I fully expect GOOG to resume its previous uptrend – perhaps even challenge its all-time highs around $750 within a year.

*Chart created using TeleChart:

Be careful out there!

Full disclosure: long GOOG