Google (GOOG) fourth quarter earnings last night were largely as expected:

“Google reported revenues of $6.67 billion for the quarter ended December 31, 2009, an increase of 17% compared to the fourth quarter of 2008…GAAP EPS in the fourth quarter of 2009 was $6.13…compared to $1.21 in the fourth quarter of 2008…Non-GAAP EPS in the fourth quarter of 2009 was $6.79, compared to $5.10 in the fourth quarter of 2008.”

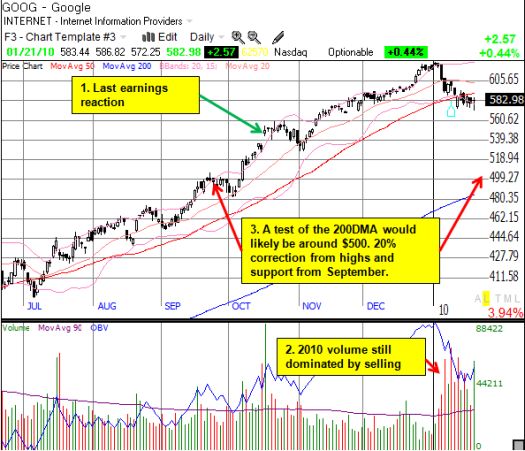

However, the news overhang on GOOG continues to weigh heavily on the stock, and it sank 4.5% in after-hours, dropping as low as $550. This trading action essentially reverses all the post-earnings gains from last quarter, and it puts the stock in between the $530-560 range that defined last quarter’s immediate post-earnings reaction.

Given the “small” decline so far, it appears the typical pattern of wiping out the value of both calls and puts will hold again in the immediate post-earnings trading. My GOOG post-earnings analysis has little to say about what to expect in the next three months after a negative post-earnings open. If the NASDAQ were also trading below where it was when GOOG last reported, then I would say the best bet is a short (note this combination has only happened three times in the past).

Given I am bullish overall on GOOG’s business, I broke my rules and held a few shares going into earnings (initiated just prior to earnings despite the negative headwinds facing the stock). Given the heavy downside volume in GOOG preceding earnings, there is a chance of a wash-out kind of day today, but I would remain cautious before considering adding a few more shares. For example, $530 needs to hold as support (an open and hold above $560 would be a best case). Also, news and event risk become extremely high now that governments are actively involved in the GOOG vs China spat (do not forget that GOOG CEO Eric Schmidt was a technology adviser to President Obama!).

As a worst case scenario, I am preparing for an eventual test of the 200-day moving average (DMA) around $500. This also happens to represent a 20% correction from the closing highs set at the beginning of the year. If GOOG breaks those levels, it becomes a (near-term) short.

*Chart created using TeleChart:

Be careful out there!

Full disclosure: long GOOG

2 thoughts on “Google’s Stock Reverses Last Quarter’s Gains”